Bitcoin and ether sliding

The value of major cryptocurrencies including bitcoin are tumbling this morning, as anxiety over the US economy fuels volatility in the financial markets.

Bitcoin has dropped by roughly 8% in the last 24 hours to around $88,000, its lowest level since mid-November last year.

That means the world’s largest crypto coin has lost around 6% off its value since the start of 2025, having fallen back from record highs of $109,000 late last year.

Ether, the currency for the ethereum network, is also falling, down 10% in the last 24 hours.

The cryptocurrency world is reeling from the biggest digital theft in history, in which $1.5bn of ether was stolen from Dubai-based crypto platform Bybit.

Today’s selloff also comes amid rising volatility in the markets; shares on Wall Street fell on Friday and Monday, on concerns that the US economy may be slowing.

Kathleen Brooks, research director at XTB, says high volatility is weighing on crypto:

Bitcoin is sharply lower and is below $90,000, which is a sign that the current environment of rising volatility is not conducive to cryptocurrency gains.

The gold price, which has risen to fresh record highs in recent days, slipped early on Tuesday, however, it is clawing back earlier losses now that Europe has opened. The low for the day is $2929, but if risk sentiment continues to falter, we expect the gold price to continue to recover in the short term.

After Donald Trump won the US election last November there was speculation that the US would take a more pro-crypto approach, and possibly create a bitcoin strategic reserve.

Naeem Aslam, chief investment officer at Zaye Capital Markets, says:

Since President Donald Trump’s inauguration in January 2025, Bitcoin has experienced a notable decline, dropping over 13% from $106,000 to $92,000.

Trump was supposed to be a good luck for crypto but now it appears that things are totally opposite.

We do also think that this downturn is attributed to geopolitical concerns, economic uncertainties, and unpredictable policy shifts under the new. administration. Additionally, a significant security breach involving the Bybit crypto exchange, resulting in a $1.5 billion theft primarily in Ethereum, has further dampened market sentiment.

Key events Show key events only Please turn on JavaScript to use this feature

Shares in defence company BAE Systems are rising, following the news that Sir Keir Starmer is to give a surprise statement to MPs at 12.30pm on “defence and security”.

My colleague Andrew Sparrow writes:

We have not been told what he will be announcing, but a ministerial statement by the prime minister is normally big news, and there is speculation that he might have something significant to say about defence spending ahead of his meeting with President Trump in the White House on Thursday.

The government has a theoretical commitment to raise defence spending to 2.5% of GDP, but it has not said when this will happen, or even if it will be before the next election. Until recently ministers have been saying that the decision will be announced when the strategic defence review is published in the spring.

But Starmer is going to want to arrive in Washington with some news that will impress Trump, and the one thing the US president gets most praise from in Europe is being right about the need for Nato countries to spend more on defence. Starmer may be addressing that today.

There’s a rumour that Starmer may slash the UK aid budget to fund higher spending on defence….

UK PM STARMER TO SLASH BRITAIN'S AID BUDGET TO IMMEDIATELY HIKE DEFENCE SPENDING TO 2.5 PER CENT OF GDP - THE SUN REPORTER

— *Walter Bloomberg (@DeItaone) February 25, 2025BAE Systems are up 3.2% today, adding to their recent gains on expectations of higher European defence spending.

Joel Kruger, market strategist at LMAX Group, reckons two factors are responsible for the drop in crypto prices:

“The crypto market has gotten off to a tough start in 2025. We believe there are two material factors contributing to this.

The first comes down to what has already been priced in. Indeed, there has been plenty of optimism around a crypto-friendly US administration. At the same time, a lot of this optimism has already been reflected in the price action from November through January, leaving the market exposed to a sell-the-fact type reaction. Investors are now looking for more follow-through on the administration’s policies, which should act as a catalyst for the next wave of demand.

“The other drag comes from the world of traditional markets where risk appetite has cooled off in response to global trade tension and a more hawkish Fed outlook.

As far as this goes, we believe correlations between bitcoin and traditional risk assets can be misleading, with bitcoin easily capable of generating sizable demand as an attractive portfolio diversification asset given properties that align more with that of a store of value. Technically speaking, there is formidable support for bitcoin in the $70-$75k area, which should serve as an attractive higher low ahead of the next major upside extension and bullish continuation to a fresh record high beyond $110k.”

Over in parliament, the boss of South West Water’s owner Pennon has said she has “regret” for the pollution incidents caused by the utilities firm.

Chief executive Susan Davy told the Environment, Food and Rural Affairs Select Committee:

“I absolutely regret and do not condone those incidents and pollutions that we had.

“We do not want to harm the environment, that is not the activities that we undertake everyday.

“We have hundreds of treatment works and thousands of pumping stations and from time to time things do go wrong.”

She said there were 194 individual pollution incidents across the group between 2023 and 2024.

Pennon was fined £2.2 million in 2023 for illegal sewage spills spanning four years across Devon and Cornwall.

South West Water was also hit by a cryptosporidium outbreak in Brixham, Devon last year, which forced thousands of households and businesses to boil their tap water before drinking it.

Davy received a pay increase of £300,000, weeks later.

UK environment secretary Steve Reed is now being booed as he answers questions about inheritance tax at the National Farmers’ Union conference, Joanna adds:

Farmers are booing environment secretary Steve Reed as he answers questions about inheritance tax at NFU conference.

A farmer was applauded when asking Reed what he would say to elderly farmers who feel best tax planning to is die before tax changes come in in April 2026.

A farmer tells Steve Reed that the issue of inheritance tax is "sucking all the air out of the room" when discussing the challenges faced by farmers

— Joanna Partridge (@JoannaPartridge) February 25, 2025Farmers' leader blasts 'cruel' inheritance tax changes

Joanna Partridge

Back in London, Tom Bradshaw, president of the National Farmers’ Union (NFU), has railed against what he called the government’s “cruel” changes to inheritance tax for agricultural properties in his opening address to the organisation’s annual conference.

Bradshaw also warned that a cashflow crisis is leading farmers to question whether they can keep going until the end of the year, my colleague Joanna Partridge reports.

The government’s inheritance tax changes, announced in October’s budget, are “morally wrong and economically flawed”, Bradshaw told delegates, as he vowed to keep trying to get the policy changed:

He said:

“We will not go away and we cannot go away, we will not give in until ministers do the right thing.”.

Bradshaw said he had received “hundreds” of letters from NFU members worried about the impact of the tax changes on elderly farmers who were expecting to pass down the family farm when they die.

He said:

“I think of the grandson who wrote to me about their 94-year-old grandfather.”

“This isn’t just money, this is blood, sweat and tears. The farm is their life’s work, but as they grow older, the farm has also become their pension, because that’s what they were told to do.

Tax changes are only part of the challenges facing the nation’s farmers, Bradshaw said, listing “bad policy, geopolitics and unprecedented weather” as other pressures, which had left some sectors of UK farming “in the worst cash flow crisis ever”.

He added:

“Many farmers genuinely worry about whether they will make it to the end of 2025.”

Bradshaw criticised chancellor Rachel Reeves for refusing to meet him to discuss the tax changes, joking that he might have a better chance of arranging to see her “in Davos” at the World Economic Forum.

Bradshaw’s speech was followed by environment secretary Steve Reed. Acknowledging the difficult reception he has received at other farming events, Bradshaw said it would have easiest for Reed not to attend.

Farmers silently held up a protest banner during Reed’s speech, asking “How high up your ‘pecking order’ is eating?”.

Demonstrating the strength of feeling among some farmers, several tractors parked outside the QEII conference centre in Westminster honked their horns during his speech.

Bitcoin and ether sliding

The value of major cryptocurrencies including bitcoin are tumbling this morning, as anxiety over the US economy fuels volatility in the financial markets.

Bitcoin has dropped by roughly 8% in the last 24 hours to around $88,000, its lowest level since mid-November last year.

That means the world’s largest crypto coin has lost around 6% off its value since the start of 2025, having fallen back from record highs of $109,000 late last year.

Ether, the currency for the ethereum network, is also falling, down 10% in the last 24 hours.

The cryptocurrency world is reeling from the biggest digital theft in history, in which $1.5bn of ether was stolen from Dubai-based crypto platform Bybit.

Today’s selloff also comes amid rising volatility in the markets; shares on Wall Street fell on Friday and Monday, on concerns that the US economy may be slowing.

Kathleen Brooks, research director at XTB, says high volatility is weighing on crypto:

Bitcoin is sharply lower and is below $90,000, which is a sign that the current environment of rising volatility is not conducive to cryptocurrency gains.

The gold price, which has risen to fresh record highs in recent days, slipped early on Tuesday, however, it is clawing back earlier losses now that Europe has opened. The low for the day is $2929, but if risk sentiment continues to falter, we expect the gold price to continue to recover in the short term.

After Donald Trump won the US election last November there was speculation that the US would take a more pro-crypto approach, and possibly create a bitcoin strategic reserve.

Naeem Aslam, chief investment officer at Zaye Capital Markets, says:

Since President Donald Trump’s inauguration in January 2025, Bitcoin has experienced a notable decline, dropping over 13% from $106,000 to $92,000.

Trump was supposed to be a good luck for crypto but now it appears that things are totally opposite.

We do also think that this downturn is attributed to geopolitical concerns, economic uncertainties, and unpredictable policy shifts under the new. administration. Additionally, a significant security breach involving the Bybit crypto exchange, resulting in a $1.5 billion theft primarily in Ethereum, has further dampened market sentiment.

Ryanair predicts higher fares this summer

UK households face mor expensive airline tickets, as well as higher energy bills, this summer.

Budget airline Ryanair’s CEO predicted this morning that summer fares will rise by between 4% and 6%.

Michael O’Leary told a press conference in Warsaw:

“Fares will grow between 4% and 6% this year, so you’ll still be traveling at slightly cheaper prices than in the summer of 2023, but you’ll be a little bit up on 2024”.

O’Leary also predicted that Boeing will catch up on its delivery backlog in time for summer 2026.

Annd he suggested that Ryanair could have up to five million passengers in Ukraine within a year or two of the country’s skies being opened after a ceasefire is agreed.

Automotive analyst Matthias Schmidt said one factor behind Tesla’s sales decline in Germany could be that consumers were waiting for the upgraded Y model, scheduled for the first half of 2025, the Financial Times reports.

However, other experts have also blamed a backlash against Musk’s political involvement, they add.

Elsewhere in Europe, we have confirmation this morning that Germany’s economy contracted at the end of last year.

German GDP contracted by 0.2% in October-December, statistics body Destatis says, confirming an earlier estimate.

Jochen Stanzl, chief market analyst at CMC Markets, says:

“The GDP data were reported as expected – weak, as anticipated.

The continued decline in investments, particularly in the equipment sector, combined with the significantly lower export figures, could point to structural weaknesses that may hamper the German economy’s ability to recover in the coming quarters.

Despite the negative GDP growth, the increase in selected service sectors and the slightly higher number of working hours indicate that some positive dynamics are emerging in certain segments, which could serve as a catalyst for a future upswing.”

Bloomberg have calculated that Tesla’s sales within Europe slumped to a two-year low in January.

Tesla registered only 1,277 new cars last month in Germany, its lowest monthly total since July 2021.

Sales in France plummeted 63% in its worst showing there since August 2022.

The company also registered fewer vehicles than China’s BYD Co. for the first time ever in the UK. Tesla’s sales slumped almost 8% in an EV market that grew 42% last month.

Der Tesla-Absatz ist im Januar europaweit um 45% gegenüber Vorjahr eingebrochen — während gleichzeitig die Nachfrage nach Elektrofahrzeugen der Konkurrenz stark gestiegen ist. https://t.co/bfQUUhfGK9

— Bloomberg auf Deutsch (@BBGaufDeutsch) February 25, 2025Tesla sales almost halve across Europe

Sales of Tesla cars across Europe almost halved in January, new data shows, perhaps a sign of a consumer backlash against Elon Musk.

Just 9,945 Teslas were sold across the European Union, the UK and the EFTA region last month, the European Automobile Manufacturers’ Association (ACEA) has reported,.

That’s a 45% plunge compared with the 18,161 Teslas sold in January 2024.

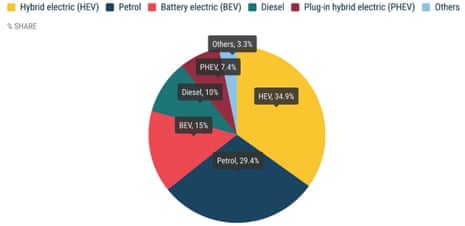

Despite the slump in demand for Teslas, sales of new battery-electric cars grew by 34% to 124,341 units, capturing a 15% market share.

The overall market shrank by 2.1%. Many of the EU’s major markets saw declines, with France (-6.2%), Italy (-5.8%), and Germany (-2.8%). Spain conversely recorded a 5.3% increase.

There have been signs in recent weeks that Musk’s backing of Donald Trump, and his interference in other country’s politics, may be hurting Tesla, one of the companies he runs.

At the start of January, the French president, Emmanuel Macron, accused the world’s richest man of intervening directly in the continent’s democratic processes.

Last month, protesters gathered outside Tesla dealerships across the US in response to Musk’s efforts to shred government spending through the ‘department of government efficency’ (DOGE).

Musk’s move to the right also saw him back Germany’s far-right Alternative für Deutschland (AfD) party in January, ahead of last weekend’s election.

He also claimed that UK prime minister Sir Keir Starmer was “complicit in the rape of Britain”, in a row over grooming gangs.

The surprise exit of Hein Schumacher will not go down well with investors, explains Chris Beckett, head of equity research at Quilter Cheviot:

“Losing a chief executive after 18 months is never a good thing. For Unilever, especially during a strategy turnaround, it does not suggest things were going well behind the scenes or the business was firing on all cylinders. The last set of results suggested that turnaround had stalled somewhat, with weak guidance and sales growth only likely to improve as the company passes on higher commodity costs.

“Evidence of quick operational improvements are needed when you are embarking on a new strategy, and with new management. The change at the top of Unilever will not see a change in that strategy, which is positive, and guidance has been reiterated. However, the new CEO, current chief financial officer Fernando Fernandez, will have been pivotal in agreeing and implementing that strategy and ultimately is the best the company could do for now. He is well liked and respected and is unlikely to rock the boat, but clearly, as recent results show, work still needs to be done to bring back that momentum.

“Unilever has a long way to go on its road to recovery. The share price offers a bit of headroom to do that, but events such as this will not go down well with investors. Results will be watched even more closely now to ensure there are no signs of cracks within that turnaround strategy.”

Here’s our news story about the rise in the energy price cap:

The FT are reporting that Unilever’s board decided to oust CEO Hein Schumacher at a board meeting yesterday, having decided that finance director Fernando Fernandez was “better suited” to execute the company’s turnaround plan.

Shares in Unilever have dropped 2% at the start of trading in London, as investors react to the surprise departure of CEO Hein Schumacher announced this morning.

Chris Venables, director of politics at Green Alliance, says:

“Energy bills are once again being pushed up because of the UK’s exposure to the global price of gas. The only way to lower energy costs for people is to insulate leaky homes and rapidly scale up homegrown renewables.

We urge the government to ensure its Warm Homes Plan and the upcoming spending review properly allocate funding to these measures. It must ignore the siren calls of denial and delay.”

Consumer champion Martin Lewis is urging households to fix their energy bills now, to avoid the increase in bills in April.

He explains that the cheapest fixed deals available on the market are around 4% cheaper than the current price cap – even before the rise 6.4% announced this morning.

Posting on X, Lewis explains:

HOW TO KNOW IF YOU’RE ON A CAPPED TARIFF

If you’re not on a fix or special deal you are likely on the Cap. It applies to firms standard default consumer tariffs, often called ‘Standard Variable’ or ‘Flexible’ tariffs. If you don’t know assume you, like two third of homes probably are.

THE PRICE CAP IS A PANTS CAP GET OFF IT IF YOU CAN - FIX NOW IF YOU HAVEN’T ALREADY

The cheapest year-long standalone fixes right now are about 4% LESS than the current Cap, never mind once it rises in April, so if you get a good fix now you lock in at a cheaper rate for a year, get price certainty, save instantly and save relatively more once we get to April.

Speaking on Radio 4’s Today programme now, Lewis says he’s hearing that “some good tariffs” are being launched this morning – so consumers should wait until lunchtime for making comparisons.

Money Advice Trust, the charity that runs National Debtline, reports that energy arrears are now the second most common debt they help people with, behind only credit cards.

April’s jump in the price cap will probably make this worse.

Steve Vaid, chief executive at the Money Advice Trust, says:

“This latest price rise will only add to the challenges many people face in keeping up with their bills.

“Ofgem must press ahead with their plans for a Help to Repay scheme, to bring energy debt down, while the Government must urgently bring in targeted bill support through an energy social tariff.

“Anyone struggling with their energy bills, or worried about their finances, should contact a free debt advice charity, like National Debtline.”

3 months ago

43

3 months ago

43