Introduction: China’s economy expands at slowest pace in a year

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

Growth across China’s economy has slowed to its lowest level in a year, as the trade war with the US has dampened activity.

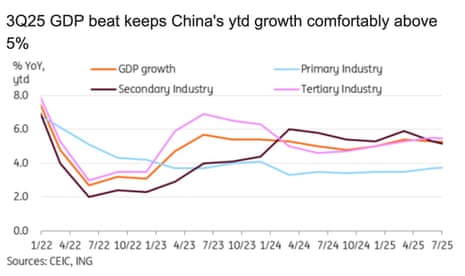

China’s GDP expanded by 4.8% year-on-year in the July-September quarter, new data from the National Bureau of Statistics (NBS) shows shows, broadly matching expectations. That’s a slowdown from the second quarter of the year, when GDP rose by 5.2%, and also weaker than the 5.4% growth recorded in January-March.

The annual slowdown casts something of a shadow over China’s latest four-day “fourth plenum” meeting which starts today, where Communist party leaders are gathering to hammer out the country’s next five-year plan.

But on a quarterly basis, GDP grew 1.1% in the third quarter, compared with a forecast 0.8% increase and a revised 1.0% gain in the previous quarter.

Today’s data showed that China’s retail sales remained weak while factory output strengthened, a blow to hopes that its economy can rebalance away from exports and towards domestic consumption.

Growth in industrial production rose to 6.5% year-on-year in September, up from 5.2%, while retail sales growth slowed to 3% from 3.4%

The NSB took a loyally upbeat view of the economic situation, reporting that…

The national economy sustained the steady development momentum with progress against the pressure, production and supply grew steadily, employment and prices were generally stable, new growth drivers showed stable development, and the people’s well-being was ensured in a strong and effective manner.

The national economy demonstrated strong resilience and vitality.

The agenda

-

10am BST: Eurozone GDP report for Q2 2025 (updated reading)

-

3pm BST: CB Leading index survey of the US economy

Key events Show key events only Please turn on JavaScript to use this feature

B&M shares slide after admitting accounting blunder

Shares in UK discount retailer B&M have slumped by 15% after admitting an embarrassing mistake in its recent financial results.

B&M told the City this morning that approximately £7m of overseas freight costs had not been correctly recognised in its calculations for the cost of goods sold, in its recent results for the first half of the financial year.

As a ressult, it now expects to report adjusted profits of approximately £191m, compared to the previous guidance of approximately £198m, for the first half of this financial year.

For the full year, B&M has slashed its forecast for adjusted profits to between £470m and £520m, down from the previous estimate of £510m - £560m.

B&M says it intends to commission a comprehensive third-party review of this matter, addinng that Mike Schmidt is stepping down as its chief financial officer, presumably carrying the can for this blunder.

The London stock market has opened higher, as European shares recover some of last Friday’s losses.

The FTSE 100 index of blue chip shares has gained 29 points, or 0.3%, to 9,382 points.

Banks are among the risers, including Standard Chartered (+2%) and HSBC (+1.6%), having fallen at the end of last week as worries over the health of the US regional banking sector worried investors.

That selloff started after Western Alliance Bank and Zions Bank reported problems with bad loans.

Stocks did rise off their lows on Friday afternoon after Donald Trump confirmed he will meet soon with president Xi, and appeared to backtrack on his threat of new 100% tariffs.

Other European markets are also higher this morning, with Germany’s DAX index rising 0.8% at the open and France’s CAC 40 up 0.6%.

Michael Brown, senior research strategist at brokerage Pepperstone, sounds relieved that the regional banking panic may be over, saying:

At least participants appear to no longer be pointlessly worrying about insignificant financial institutions that nobody has ever heard of, and re-focusing on what remains a constructive setup for risk assets as we move towards year-end.

Japan’s stock market has surged today, and closed at a new record high.

The Nikkei 225 jumped by 3.3% to end the day at 49,185, having risen over the 49,000 point mark for the first time.

Japanese stocks were lifted by news the Liberal Democratic Party and the Japan Innovation Party have agreed to form a coalition government, setting the stage for the country’s first female prime minister.

Sanae Takaichi is expected to favour fresh measures to stimulate Japan’s economy, and oppose further hikes in interest rates, two things which are good for stock prices.

Chinese leader Xi Jinping has delivered a speech to Communist Party elites on the opening day of a major meeting to approve a draft plan laying out their goals for the country over the next five years.

The official Xinhua News Agency report is light on detail, but says:

Xi Jinping, general secretary of the CPC Central Committee, delivered a work report on behalf of the Political Bureau of the CPC Central Committee and expounded on the Party leadership’s draft proposals for the formulation of the 15th Five-Year Plan (2026-2030) for national economic and social development.

Asia-Pacific stock markets are rallying today, as investors digest the latest economic data from China.

China’s CSI 300 index has inched up by 0.25%, while Hong Kong’s Hang Seng has boucned by 2% as traders put last Friday’s markets wobble behind them.

Today’s trade data shows that China’s exports of rare earth magnets fell in September.

China’s shipments of rare earth magnets fell 6.1% month-on-month, customs data analysed by Reuters showed on Monday, ending three months of gains.

That shows that rare earth exports were falling evern before Beijing tightened up its exports, a move which promted Donald Trump to threaten 100% tariffs on China.

Despite slowing in the last quarter, China’s economy still seems to be on track to hit Beijing’s target of 5% growth in 2025.

That means there could be less urgency to agree new stimulus policies – something Lynn Song, ING’s chief economist for Greater China, thinks woud be a mistake.

Song explains:

With China on track to hit this year’s growth target, we could see less policy urgency. But weak confidence translating to soft consumption, investment, and a worsening property price downturn still need to be addressed.

The third quarter GDP data keeps China solidly on pace to reach this year’s “around 5%” growth target, and it may reduce the urgency for more immediate action. This could prove to be a mistake, as the underlying trend makes a strong case for more policy support.

China's new home prices fall at fastest pace in 11 months

China’s new home prices fell at the fastest pace in 11 months in September, worsening the property sector’s drag on the economy.

New home prices fell 0.4% month-on-month, following a 0.3% fall in August, according to calculations by Reuters based on National Bureau of Statistics data. Year-on-year, prices fell 2.2% in September versus a 2.5% drop in August.

That is a blow to China’s property sector, which is being dragged back by a large glut of unsold property following the end of the housing boom.

September and October are traditionally the peak season for property buying as developers launch sales campaigns to attract consumers during national holidays.

Introduction: China’s economy expands at slowest pace in a year

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

Growth across China’s economy has slowed to its lowest level in a year, as the trade war with the US has dampened activity.

China’s GDP expanded by 4.8% year-on-year in the July-September quarter, new data from the National Bureau of Statistics (NBS) shows shows, broadly matching expectations. That’s a slowdown from the second quarter of the year, when GDP rose by 5.2%, and also weaker than the 5.4% growth recorded in January-March.

The annual slowdown casts something of a shadow over China’s latest four-day “fourth plenum” meeting which starts today, where Communist party leaders are gathering to hammer out the country’s next five-year plan.

But on a quarterly basis, GDP grew 1.1% in the third quarter, compared with a forecast 0.8% increase and a revised 1.0% gain in the previous quarter.

Today’s data showed that China’s retail sales remained weak while factory output strengthened, a blow to hopes that its economy can rebalance away from exports and towards domestic consumption.

Growth in industrial production rose to 6.5% year-on-year in September, up from 5.2%, while retail sales growth slowed to 3% from 3.4%

The NSB took a loyally upbeat view of the economic situation, reporting that…

The national economy sustained the steady development momentum with progress against the pressure, production and supply grew steadily, employment and prices were generally stable, new growth drivers showed stable development, and the people’s well-being was ensured in a strong and effective manner.

The national economy demonstrated strong resilience and vitality.

The agenda

-

10am BST: Eurozone GDP report for Q2 2025 (updated reading)

-

3pm BST: CB Leading index survey of the US economy

3 months ago

49

3 months ago

49