Key events Show key events only Please turn on JavaScript to use this feature

JLR sales fall 25% in December as it makes just one Jaguar

In Europe as a whole, taking in the EU, European free trade area and the UK, car sales grew by 7.6% to 1.2m vehicles in December, and by 2.4% to 13.3m cars in 2025, according to those industry figures from the ACEA.

Jaguar Land Rover, which is still recovering from a crippling cyber attack in September that halted production for weeks, posted a 25.3% fall in sales in December sales to 4,332. Over 2025, sales were down 17% to 53,161.

The carmaker, owned by India’s Tata Motors, produced only one Jaguar in December compared with 372 a year earlier. The rest of its sales were made up by Land Rover.

The factory shutdown following the cyber attack pushed the company from profit into a quarterly loss of almost £500m in the three months to 30 September. The hack has been estimated to have cost the wider UK economy up to £1.9bn, and was blamed by the government for dragging down the quarterly GDP growth figures.

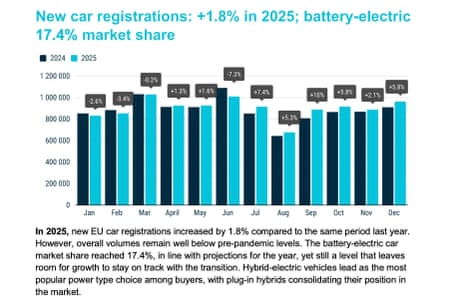

Introduction: EU car sales grow 1.8% in 2025 with electric cars surging while Tesla loses market share

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Sales of new cars in the European Union rose by 1.8% last year, with electric cars making up a bigger share of the market, while Tesla sales plummeted as it lost ground to China’s BYD.

However, overall car volumes remain well below pre-pandemic levels, the European Automobile Manufacturers’ Association (ACEA) cautioned. EU car sales rose by 5.8% to 963,319 vehicles in December and by 1.8% to 10.8m in 2025 versus 2024.

More people are switching to electric cars: Nearly 1.9m battery-electric cars were registered which made up 17.4% of sales, up from 13.6% a year earlier. Hybrid electric cars remain the most popular choice among European consumers, accounting for 34.5% of the market. Meanwhile, the combined market share of petrol and diesel fell to 35.5% from 45.2%.

The four largest markets in the EU, which together account for 62% of battery electric car sales, saw growth: Germany (+43.2%), the Netherlands (+18.1%), Belgium (+12.6%), and France (+12.5%).

By the end of 2025, petrol car sales were down by 18.7%. France experienced the steepest drop, with registrations plummeting by 32%, followed by Germany (-21.6%), Italy (-18.2%), and Spain (-16%).

In December, battery-electric car sales in the EU surged by 51% while plug-in hybrid electric cars jumped 36.7% and hybrid electric vehicles recorded a 5.8% increase.

Tesla sales fell by 31.9% in December to 21,485, taking its market share to 2.2% from 3.5%. Over the year as a whole, sales were down 37.9% to 150,504 vehicles.

The US company run by Elon Musk lost share to China’s BYD, whose sales nearly tripled in December to 18,008, more than doubling its market share to 1.9% from 0.7%. In 2025, BYD more than tripled sales to 128,827.

Shenzhen-based BYD overtook Tesla as the world’s largest electric carmaker in 2025, after Donald Trump withdrew electric vehicle subsidies and emissions regulations that incentivised electric car production. Tesla also faced a backlash from some consumers after Musk’s embrace of far-right politics at the end of 2024.

In financial markets, gold continues its historic rally, rising 1.5% this morning to $5,091.64 an ounce (spot gold).

There may be exciting news for pubs later today: the UK chancellor, Rachel Reeves, is expected to unveil a support package worth around £100m a year for the struggling sector, after being warned of widespread closures and job losses following controversial changes to business rates in the budget.

The chancellor is expected to announce the relief package on Tuesday, after officials admitted that they had not foreseen the total financial impact of the rates shake-up in England and Wales announced in the budget in late November.

The Agenda

-

11.30am GMT: Rachel Reeves gives speech

-

1.15pm GMT US ADP Employment change

-

3pm GMMT: US Conference Board Consumer confidence for January

-

5pm GMT: European Central Bank president Christine Lagarde speech

3 weeks ago

25

3 weeks ago

25