Factory activity shrinks as US tariffs bite

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

Factories across Asia-Pacific countries have been hit by a drop in activity last month, as Donald Trump’s trade wars hit demand.

Surveys of purchasing managers from across the region, which are being released today, show that manufacturing output declined during August.

In Japan, new export business contracted at the sharpest rate since March 2024, according to the latest survey from data provider S&P Global. with factory activity shrinking again.

The S&P Global Japan Manufacturing Purchasing Managers’ Index rose to 49.7 in August, up from 48.9 in July, but still below the 50-point mark separating expansion from contraction.

Annabel Fiddes, economics associate director at S&P Global Market Intelligence said:

The latest PMI data signalled that manufacturing conditions in Japan moved closer to stabilisation in August, helped by a softer fall in output.

Demand conditions remained sluggish, however, with overall new work continuing to fall modestly. Of particular concern was a steeper drop in new export business, which fell at the sharpest pace in nearly a year and-a-half.

In early August, Donald Trump latest swathe of country-specific tariffs came into effect, with Japan’s products now attracting a 15% levy.

In South Korea, manufacturers have reported ‘sustained and solid reductions in output and new orders’ last month, which they blamed on a subdued domestic economy and global trade uncertainty.

The S&P Global South Korea Manufacturing Purchasing Managers’ Index came in at 48.3 in August, up slightly from 48.0 in July, but showing the seventh successive month of worsening business conditions.

Manufacturing conditions also continue to weaken in Taiwan, where goods producers reported sharp reductions in both output and new orders.

Taiwanese manufacturers reported that customer demand had fallen both at home and overseas, and that uncertainty over US tariffs and the wider global economic climate also dampened confidence regarding the year-ahead.

S&P Global’s Annabel Fiddes reports:

“The latest PMI data indicated that the performance of Taiwan’s manufacturing sector continued to be dampened by weak global demand conditions amid lingering uncertainty over US tariffs.

Although firms signalled softer falls in output and new orders compared to July, rates of contraction remained historically marked overall, with businesses often noting that uncertainty over future US trade policy had led to greater hesitation among clients to commit to new projects.

China, which is locked in negotiations over a trade deal with the US, also continued to suffer from tariff uncertainty.

China’s manufacturing activity shrank for a fifth straight month in August, an official survey showed on Sunday, with its factory PMI rising to 49.4 from 49.3 in July.

The future of global trade was plunged into further uncertainty last week when the US court of appeals ruled that Donald Trump’s tariffs were unconstitutional, as the US president was not legally allowed to declare national emergencies and impose import taxes on other countries.

This is likely to lead to a showdown at the Supreme Court.

The agenda

-

7am BST: Nationwide’s UK house price index for August

-

9am BST: Eurozone manufacturing PMI report for August

-

9.30am BST: Bank of England’s mortgage approvals and consumer credit data

-

9.30am BST: UK manufacturing PMI report for August

-

10am BST: eurozone unemployment report

Key events Show key events only Please turn on JavaScript to use this feature

European Central Bank president Christine Lagarde has weighed in on the crisis in France, saying that any risk of a government falling in the euro zone is “worrying”.

Speaking to broadcaster Radio Classique, Lagarde said France is not currently in a situation that would need the International Monetary Fund (IMF) to intervene.

But she insisted that fiscal discipline remained imperative in France, and that she was looking very attentively at the French bond spreads situation.

The French government could collapse next week, when parliament hold a confidence vote over plans to slash public spending.

BAE shares rise after Norway warship deal

The London stock market has begun the new month on the front foot.

The FTSE 100 index of blue-chip shares has gained 27 points, or 0.3%, to 9213 points.

Defense firm BAE Systems are the top risers, up 2.8%, after Norway agreed a £10bn deal to buy Type 26 anti-submarine warships from the UK. They’ll be constructed at BAE’s shipyards in Glasgow.

BYD shares fall after slump in profits

Back in the world of manufacturing, China’s electric carmaker BYD is feeling the pain from a domestic price war.

Shares in BYD have fallen 4% today, after it reported a 30% drop in quarterly profits on Friday.

BYD posted a net profit of 6.36 billion yuan ($891 million) in April-June last Friday, missing estimates of 7-9 billion yuan.

BYD, which has overtaken Tesla for sales in Europe, also reported a rise in overseas sales, which helped push revenues up by 14%.

UK house prices: what the experts say

Here’s some early reaction to the news that UK house prices dipped last month.

Karen Noye, mortgage expert at Quilter, says affordability pressures are still weighing heavily on the housing market:

“Last week’s property transaction figures pointed to relatively steady buyer demand, with July seeing 95,580 residential transactions – a 4% increase compared to the same month last year. However, the most recent inflation print has complicated the outlook for interest rates. Mortgage rates have been easing slightly but typical fixed deals remain around 4%, keeping monthly payments elevated, and higher inflation will make the path to lower interest rates even longer.

“Speculation around potential reforms in the Chancellor’s upcoming budget, including possible levies on high-value homes or changes to capital gains tax on primary residences, could also cause hesitation among sellers. This would tighten supply further and paradoxically push prices higher, worsening conditions for new entrants to the market.

Tom Bill, head of UK residential research at estate agent Knight Frank, agrees that speculation over budget tax changes could cool the market.

“House prices have drifted lower since March as the market digests higher rates of stamp duty and supply continues to outstrip demand.

Steady mortgage rates mean transaction numbers have improved over that time but the recent property tax speculation risks sending both sales and prices lower as buyers and sellers deal with pre-Budget uncertainty for the second year in a row.”

According to lender @AskNationwide HPI for August: UK house prices sweated under the glare of Reeves’ property tax musings and the holiday sun. Houses prices down 0.1% month-on-month to £271,079. Moving forward they continue to “bank” on improved affordability from lower rates as… pic.twitter.com/CLcKLp7eni

— Emma Fildes (@emmafildes) September 1, 2025Marc von Grundherr, director of estate agent Benham and Reeves, reckons the market will pick up in September….

“August’s marginal dip is no surprise, with the school holidays always proving disruptive for buyers and sellers. However, this is nothing more than a seasonal summer slump as our plans to move take a backseat in favour of holidays and longer days spent in the sun with family and friends.

Now that September has arrived it brings with it a greater degree of normality where our day to day routines are concerned and so we should see momentum return quickly, with greater consistency in both market activity and house price growth.”

Nationwide: Housing affordability could improve

Nationwide also expects income growth to continues to outpace house price growth.

That would mean that housing affordability should continue to improve, if gradually.

Their chief economist, Robert Gardner, says further cuts to UK interest could also help:

Borrowing costs are likely to moderate a little further if Bank Rate is lowered again in the coming quarters.

This should support buyer demand, especially since household balance sheets are strong and labour market conditions are expected to remain solid.

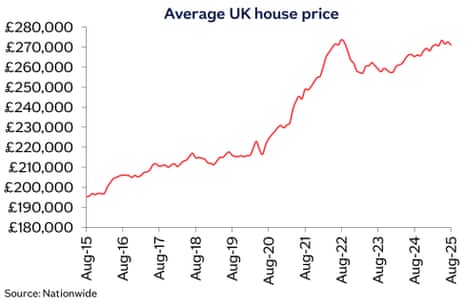

UK house prices dipped unexpectedly in August

We also start the new month with news that UK house prices fell last month.

Lender Nationwide reports that the average UK house price dipped by 0.1% in August, surprising economists who had forecast a 0.2% rise.

The average price of a property sold in the month dropped to £271,079, down from £272,664 in July.

On an annual basis, house price inflation slowed to 2.1%, from 2.4% the previous month.

In July, prices had jumped by 0.5% as the market recovered from a dip in June after the end of a tax break on stamp duty. In August, though, the market softened again.

Robert Gardner, Nationwide’s chief economist, says that high mortgage costs are weighing on the market:

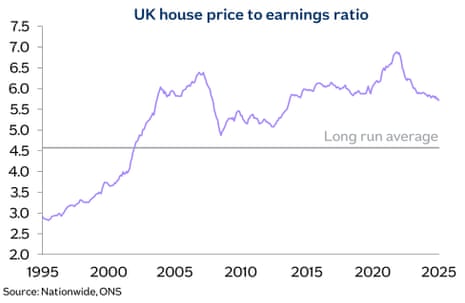

“The relatively subdued pace of house price growth is perhaps understandable, given that affordability remains stretched relative to long-term norms. House prices are still high compared to household incomes, making raising a deposit challenging for prospective buyers, especially given the intense cost of living pressures in recent years.

“Combined with the fact that mortgage costs are more than three times the levels prevailing in the wake of the pandemic, this means that the cost of servicing a mortgage is also a barrier for many. Indeed, an average earner buying the typical first-time buyer property with a 20% deposit faces a monthly mortgage payment equivalent to around 35% of their take-home pay, well above the long run average of 30%.

Factory activity shrinks as US tariffs bite

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

Factories across Asia-Pacific countries have been hit by a drop in activity last month, as Donald Trump’s trade wars hit demand.

Surveys of purchasing managers from across the region, which are being released today, show that manufacturing output declined during August.

In Japan, new export business contracted at the sharpest rate since March 2024, according to the latest survey from data provider S&P Global. with factory activity shrinking again.

The S&P Global Japan Manufacturing Purchasing Managers’ Index rose to 49.7 in August, up from 48.9 in July, but still below the 50-point mark separating expansion from contraction.

Annabel Fiddes, economics associate director at S&P Global Market Intelligence said:

The latest PMI data signalled that manufacturing conditions in Japan moved closer to stabilisation in August, helped by a softer fall in output.

Demand conditions remained sluggish, however, with overall new work continuing to fall modestly. Of particular concern was a steeper drop in new export business, which fell at the sharpest pace in nearly a year and-a-half.

In early August, Donald Trump latest swathe of country-specific tariffs came into effect, with Japan’s products now attracting a 15% levy.

In South Korea, manufacturers have reported ‘sustained and solid reductions in output and new orders’ last month, which they blamed on a subdued domestic economy and global trade uncertainty.

The S&P Global South Korea Manufacturing Purchasing Managers’ Index came in at 48.3 in August, up slightly from 48.0 in July, but showing the seventh successive month of worsening business conditions.

Manufacturing conditions also continue to weaken in Taiwan, where goods producers reported sharp reductions in both output and new orders.

Taiwanese manufacturers reported that customer demand had fallen both at home and overseas, and that uncertainty over US tariffs and the wider global economic climate also dampened confidence regarding the year-ahead.

S&P Global’s Annabel Fiddes reports:

“The latest PMI data indicated that the performance of Taiwan’s manufacturing sector continued to be dampened by weak global demand conditions amid lingering uncertainty over US tariffs.

Although firms signalled softer falls in output and new orders compared to July, rates of contraction remained historically marked overall, with businesses often noting that uncertainty over future US trade policy had led to greater hesitation among clients to commit to new projects.

China, which is locked in negotiations over a trade deal with the US, also continued to suffer from tariff uncertainty.

China’s manufacturing activity shrank for a fifth straight month in August, an official survey showed on Sunday, with its factory PMI rising to 49.4 from 49.3 in July.

The future of global trade was plunged into further uncertainty last week when the US court of appeals ruled that Donald Trump’s tariffs were unconstitutional, as the US president was not legally allowed to declare national emergencies and impose import taxes on other countries.

This is likely to lead to a showdown at the Supreme Court.

The agenda

-

7am BST: Nationwide’s UK house price index for August

-

9am BST: Eurozone manufacturing PMI report for August

-

9.30am BST: Bank of England’s mortgage approvals and consumer credit data

-

9.30am BST: UK manufacturing PMI report for August

-

10am BST: eurozone unemployment report

3 months ago

55

3 months ago

55