Reeves: Fall in GDP is disappointing

Chancellor Rachel Reeves has described the latest GDP figures as “disappointing”.

Following this morning’s news that the UK economy contracted by 0.1% in May, Reeves points to the government’s efforts to support households financially:

“Getting more money in people’s pockets is my number one mission. While today’s figures are disappointing, I am determined to kickstart economic growth and deliver on that promise.

“The choices we have made in our first year in government have seen us extend the £3 bus fare cap, fund Free School Meals for over half a million more children, press ahead with plans to deliver free breakfast clubs for every child in the country and increase the National Minimum and National Living Wage, giving a pay rise to 3 million workers.

“There’s more to do, that’s why in the Spending Review we boosted investment and jobs, through better city region transport and record funding for affordable homes, as well as backing major projects like Sizewell C.”

Key events Show key events only Please turn on JavaScript to use this feature

ING: UK GDP falls in May amid growing concern about the economic outlook

Analysts at Dutch bank ING say there are “growing concerns” about the UK economy, not helped by the drop in GDP in May.

But…. they also point out that the UK GDP figures have been incredibly volatile this year, and suggest that “May’s decline looks more like noise than signal”.

[Actually, there’s a broader debate on the wisdom of calculating GDP data each month, rather than wrapping the data up each quarter as most other countries do].

James Smith, ING’s developed markets economist, points out that May’s weakness follows a very strong first quarter, when the UK economy grew by 0.7% thanks to tariff frontloading and stronger home sales ahead of the stamp duty change in April.

He adds:

Though it would be wrong to conclude from the GDP data alone that the economy is coming under greater pressure, there are genuine questions emanating from the jobs market and whether it is beginning to fall apart more quickly.

Remember that in May, payrolled employment fell at the sharpest rate outside of the pandemic (the data has been produced since 2014). This data may well be revised up, as is fairly common, but if that doesn’t happen – and indeed if June’s data is as bad as May’s – then it would raise difficult questions for both the Bank of England and the Treasury.

Stride warns of 'ticking tax timebomb'

Shadow chancellor Mel Stride has claimed the UK is facing a ‘ticking tax timebomb’, not helped by the economy shrinking in May:

“Thanks to Labour’s reckless choices the economy actually shrank in May.

“This will pile even further pressure for tax rises in the autumn.

“Labour’s costly U-turns, on winter fuel and welfare, have created a ticking tax timebomb.”

Thanks to Labour's reckless choices the economy actually shrank in May. This will pile on even further pressure for tax rises in the Autumn.

Under Labour - taxes hiked, inflation & unemployment up & growth stagnant. We can’t afford Labour. https://t.co/dllo3Zf56i

Bank of England expected to cut rates in August

The drop in GDP in May, and April, will put more pressure on the Bank of England to cut interest rates at its next meeting, in early August.

Richard Flax, chief investment officer at wealth manager Moneyfarm, says:

With inflation continuing to ease and economic momentum faltering, the case for an interest rate cut has strengthened. Markets are now likely to price in a higher probability of a 25 basis point cut, potentially bringing the base rate down from 4.25% to 4.00%.

The BoE may view this contraction as a signal that tight monetary conditions are weighing too heavily on growth.

Deutsche Bank’s Sanjay Raja agrees, predicting a cut in August, and more later this year:

For now, weakness in GDP will cement some on the MPC’s fears that demand is loosening faster than expected. An August rate cut looks almost certain. And we expect more to come in Q4-25.

Suren Thiru, ICAEW economics director, says a rate cut next month is ‘inevitable’:

“The UK’s growth trajectory in the near term is likely to tilt downwards as any uplift from higher consumer and government spending is hampered by escalating business caution, amid fears of further tax rises in this Autumn’s Budget.

“The lack of momentum in the UK economy indicated by these sluggish figures means that an August interest rate cut currently looks inevitable, despite the recent spike in inflation.”

Deutsche Bank: We don't think UK economy is at risk of faltering

Sanjay Raja, Deutsche Bank’s chief UK economist, has some encouraging words for Rachel Reeves.

He told clients this morning that Deutsche Bank does not think the UK economy is at risk of faltering.

He points out that there are encouraging economic signs:

The latest PMI data point to a rebounding economy. Household sentiment is on the rise (albeit gradually). And business sentiment has pushed above its long-run average (see the Lloyds Business Barometer and Deloitte CFO survey). Credit conditions… look steady and healthy.

And some tentative indicators are already pointing to a stabilisation in the labour market (HR1 redundancy notifications, vacancies, and DMP).

Fiscal capex should be pushing through the economy too. And some productivity growth via trade deals with India and the EU (agri-food deal) should pose some upside to supply growth over the next several quarters.

Raja adds that it’s “easy to be pessimistic on the UK economy” after two disappointing monthly falls in GDP, saying:

Certainly, there are big questions on manufacturing – which has been in the doldrums for some time now. Some defence spending should help. But we will need a global manufacturing recovery to kickstart the sector. This is the big unknown for the UK economy.

Big picture, though, it’s also worth taking a big step back: if the economy does indeed slow to 0.1% q/q in Q2-25, this would still mean that the UK economy had grown by 0.8% in the first half of the year, which would still be pretty healthy.

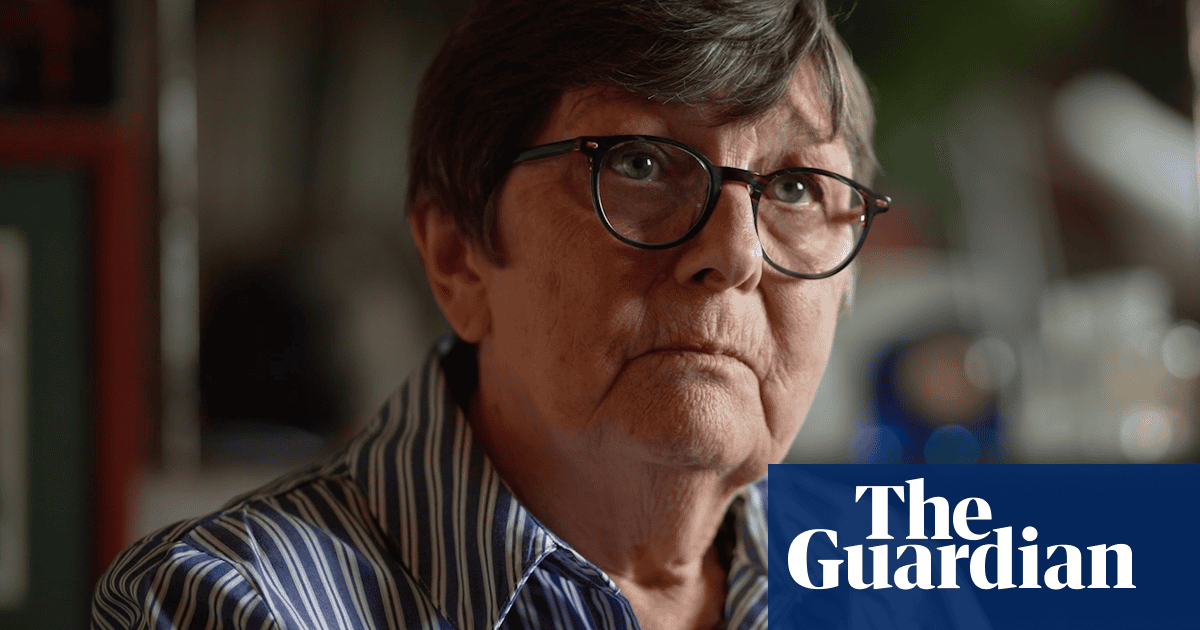

Reeves: Fall in GDP is disappointing

Chancellor Rachel Reeves has described the latest GDP figures as “disappointing”.

Following this morning’s news that the UK economy contracted by 0.1% in May, Reeves points to the government’s efforts to support households financially:

“Getting more money in people’s pockets is my number one mission. While today’s figures are disappointing, I am determined to kickstart economic growth and deliver on that promise.

“The choices we have made in our first year in government have seen us extend the £3 bus fare cap, fund Free School Meals for over half a million more children, press ahead with plans to deliver free breakfast clubs for every child in the country and increase the National Minimum and National Living Wage, giving a pay rise to 3 million workers.

“There’s more to do, that’s why in the Spending Review we boosted investment and jobs, through better city region transport and record funding for affordable homes, as well as backing major projects like Sizewell C.”

UK economy shrinks: snap reaction

Economists are rushing to react to the 0.1% drop in UK economic activity in May.

Ben Jones, CBI lead economist, says the UK faces a ‘sluggish recovery’:

“Flatlining growth in May highlights the ongoing pressures facing the UK economy, with manufacturing and retail struggling, alongside a patchy performance across other parts of the services sector.

“Today’s data suggests that a sluggish recovery remains the likeliest path in the near-term amid persistent trade uncertainty, a loosening labour market and slowing growth in real incomes. And with business costs rising, many firms are maintaining a cautious approach to investment.

Jeremy Batstone-Carr, European strategist at Raymond James Investment Services, fears the UK will record a “shallow contraction” in the second quarter of this year:

“Today’s data confirms that the growth recorded over Q1 2025 was a one-off occurrence, owing to economic activity pulled forward ahead of the US’s “Liberation Day” tariff deadline. Although the UK has struck a trade deal with the US, much of the detail is yet to be sorted out. Meanwhile, the delayed deadline for other countries has only prolonged uncertainties that have impacted UK growth.

“April’s GDP reversal provided clear evidence that there has not been a sustained improvement in economic activity, reinforced by yet another downbeat month which leaves the economy on track for a shallow contraction once June’s data sees the end of Q2.

“The Labour government will be hoping that the UK economy might generate momentum over the second half of the year, perhaps supported by further rate cuts from the Bank of England. However, this hopeful outturn remains uncertain, with growing fears that taxes might be increased again at the Autumn Budget. All hints suggest that the UK economy will suffer a very downbeat year in 2025, before staging a partial improvement in 2026.”

Hailey Low, associate economist at the National Institute of Economic and Social Research (NIESR), fears growth propects are ‘muted’:

Today’s growth figure of -0.1 per cent in May following April’s contraction indicates that the UK’s economic outlook remains fragile. Failure to implement the planned spending cuts has further eroded the UK’s fiscal space and it’s ability to respond to future shocks. Combined with depressed hiring intentions and strained public finances, growth prospects remain muted in the medium term.

With fiscal space increasingly constrained, the Chancellor faces hard trade-offs this autumn budget, having to raise taxes or cut spending to meet her self imposed rules.”

Paul Dales, chief UK economist at Capital Economics, predicts growth will slow sharply this quarter:

If GDP were flat in June, then the 0.7% q/q gain in Q1 would be followed by a 0.1% q/q rise in Q2 as a whole (BoE forecast +0.25%). The underlying pace of growth is somewhere in between.

We think GDP will rise by a fairly subdued 1.0% this year due to the lingering drags from a weakening global economy and the rises in domestic taxes for UK businesses.

Manufacturing output fell, led by pharma and cars

Digging into the GDP report, we can see that UK manufacturing output fell by 1.0% in May 2025, following a 0.7% fall in April 2025.

Manufacturing was the largest contributor to the overall decrease in production output in May 2025, with 9 of the 13 subsectors declining, the Office for National Statistics reports.

There was a 4.2% drop in the manufacture of basic pharmaceutical products and pharmaceutical preparations, following growth of 5.4% in April 2025. This may be because US customers tried to front-run Donald Trump’s trade war earlier this year by importing more pharma products.

The manufacture of transport equipment also fell in May 2025, by 1.3%, following a fall of 5.3% in April 2025. Both monthly declines were largely because of the manufacture of motor vehicles, trailers and semi-trailers industry, the ONS says.

The manufacture of basic metals and metal products also contributed negatively, falling by 1.8% in May 2025.

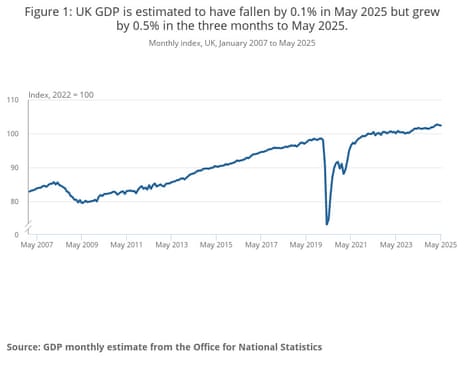

Today’s GDP report shows that the UK economy grew by 0.5% in March-May, compared to the three months to February.

That was “largely driven by growth in the services sector in this period”.

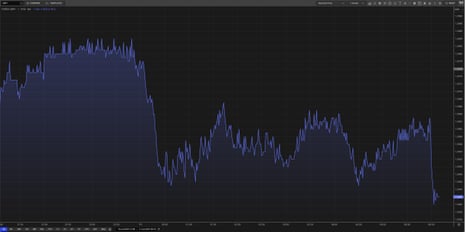

Pound weakens after poor GDP report

The pound has dropped against the US dollar, as investors react to this morning’s worse-than-expected GDP report.

Sterling has lost a third of a cent to $1.354, a drop of 0.2%.

ONS: economy still grew over the last three months

ONS director of economic statistics Liz McKeown points out that the UK economy still grew over the March-May quarter:

“The economy contracted slightly in May with notable falls in production and construction, only partially offset by growth in services. However, across the latest three months as a whole, the economy still grew. This reflected strength earlier in the year that resulted, in part, from some activity being brought forward to February and March.

“May’s fall in production was driven by oil and gas extraction, car manufacturing and the often-erratic pharmaceutical industry.

“While services grew overall in May with a strong month for legal firms, which recovered from a weak April, and computer programming, these were partially offset by a very weak month for retail sales.”

UK GDP: the key chart

UK economy shrinks again in May

Newsflash: The UK economy has shrunk for the second month running, in a blow for chancellor Rachel Reeves.

UK GDP contracted by 0.1% in May, new data from the Office for National Statistics shows, rather weaker than the 0.1% growth expected.

The fall follows a 0.3% drop in GDP in April, and growth of 0.4% in March (revised up from +0.2%).

May’s contraction was driven by a slump in industrial production, and construction work, with modest growth in the services sector.

The ONS reports:

-

Monthly services output grew by 0.1% in May 2025, following a fall of 0.3% in April 2025 (revised up from a 0.4% fall in our previous publication), and grew by 0.4% in the three months to May 2025.

-

Production output fell by 0.9% in May 2025, following an unrevised fall of 0.6% in April 2025, but grew by 0.2% in the three months to May 2025.

-

Construction output fell by 0.6% in May 2025, following growth of 0.8% in April 2025 (revised down from 0.9% growth in our previous publication), but grew by 1.2% in the three months to May 2025.

Trump threatens 35% tariffs on Canadian goods

Overnight, Donald Trump’s trade war has taken another twist.

The US president has announced his will impose a 35% tariff on imports from Canada next month and threatened to impose blanket tariffs of 15% or 20% on most other trade partners.

In a letter released on his social media platform, Trump told Mark Carney, the Canadian prime minister, the new rate would go into effect on 1 August and would increase if Canada retaliated.

Introduction: UK's May GDP report coming up

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

We’re about to discover how the UK economy fared in May, the month in which Britain became the first country this year to agree a trade deal with Donald Trump.

Economists predict the UK economy grew slightly in May, by 0.1%, after a disappointing 0.3% contraction in April.

The government will be hoping for signs that activity picked up in May, given the push for growth. The data is due at 7am UK time.

Victoria Scholar, head of investment at interactive investor, says:

April’s decline was caused by a drop in legal activities linked to the stamp duty increase. Plus, higher energy bills, the National Insurance increase and tariff uncertainty took their toll.

After an unfortunately timed cluster of headwinds in April, it appears as though the only way is up. Consumer sentiment is already showing signs of improvement and Friday’s GDP data could add to the cheerier mood, with the potential for a rebound in activity, particularly in the key services sector. Plus, anticipation of easier monetary policy is helping to boost sentiment and the real economy. The Bank of England lowered interest rates in May with the market anticipating two more cuts this year.”

The agenda

-

7am BST: UK GDP report for May

-

7am BST: UK trade balance for May

-

9am BST: IEA’s monthly oil market report

-

2pm BST: Russia’s trade balance for May

3 months ago

57

3 months ago

57