Emmanuel Macron came back from China in early December empty-handed. The French president’s appeal to his Chinese counterpart, Xi Jinping, to help stop the war in Ukraine was never going to gain traction given Beijing’s unqualified support for Russia.

Urging Xi to address China’s surging trade surplus, the result of the country’s economic and industrial policies, predictably also fell on closed ears.

In any event, Xi’s main concerns were the imminent final politburo meeting of the year and the annual Central Economic Work Conference (CEWC) that followed. Centre stage was the passage of the new 15th five-year plan, due to be presented at the National People’s Congress in March, and what would be needed in 2026 to get it off to a good start.

We all need to pay attention as we brace for the second China shock. The first, which followed China’s accession to the WTO in 2001, was about China’s integration into the global trading system, with huge consequences for global labour and resource markets and the harm experienced by many communities around the world as firms and jobs were lost. The second one is China’s attempt to lead and dominate advanced technologies, such as electric vehicles, batteries, semiconductors, biotechnology, robotics and AI, via state-directed industrial policy on an unprecedented scale.

Beijing always enthuses about its performance at the CEWC, and this year it was similarly optimistic, asserting that it is on “the correct path”. Yet this cheerful rhetoric contrasts with the prescriptive policy measures the government is proposing to implement. These include even easier monetary policy, higher fiscal deficits, real estate stabilisation measures and increased social spending to deal with what it acknowledges is a more “complex external environment”. Such complexities include overproduction and weak demand at home, as well as ongoing risks to financial stability from the beleaguered real estate sector.

Beijing has identified strengthening domestic demand as the top task for 2026, echoing a narrative that is three to four years old. A shift in tone is nonetheless notable, along with the intent to boost household consumption and income. So far, real progress in this area has been limited and the government still misdiagnoses weak consumption as a supply problem, not a demand one. In other words, it is associated with inadequate supply of consumer goods and services.

The overarching policy framework though is about the commitment to industrial policy, which accounts for a far larger share of GDP than most countries (barring Ukraine and Russia with their huge spend on defence). After all, the government’s objective is to dominate what Xi calls the fourth Industrial Revolution by the middle of the century, as it looks to dislodge the US in the global order and establish a governance system more attuned to its political liking.

These twin goals of boosting consumption and persistent support for industry and production are potentially incompatible in some respects. For example resources, fiscal transfers, exchange rate management and regulatory and financial policies often support one aim, but not both. The emphasis on industrial policy and manufacturing is likely to prevail, and with it many of the problems that now manifest themselves in overproduction, excess capacity and deflationary risks. China’s GDP deflator, the broadest measure of inflation, has been in decline for 10 consecutive quarters.

Weak demand and strong supply translate to booming trade and the dumping of low-priced goods abroad. Indeed, the export sector is working overtime. That is reflected in China’s $1tn surplus in trade in goods this year – a third of which is with Europe and the UK.

Since 2022, export volumes out of China have risen 50%, but import volumes are barely higher. Donald Trump’s tariffs have had no effect on global imbalances, but they have certainly contributed to significant changes in the pattern of trade. Chinese goods entering the US are down by about 25%, but transhipment and trade diversion, especially to south-east Asia and Europe, have boosted Chinese exports overall.

China’s exports to Europe are now a material threat to the latter’s industrial base and jobs, with cars, machinery and high technology equipment joining older problem areas such as apparel, appliances and steel. Meanwhile, stagnant imports into China because of weak local demand and Beijing’s goal of self-reliance are restricting opportunities for producers from Europe and elsewhere to develop more business there.

Part of the reason Chinese exports are booming is an undervalued exchange rate, now about 20% lower in real effective terms than three years ago – taking it back to where it was in 2012, when Chinese manufacturing was considerably less significant. The International Monetary Fund is now urging China to reverse policy on the yuan, but the government only speaks of maintaining the “basic stability” of the currency.

In Beijing, Macron said the Chinese trade imbalance with Europe was “unbearable”, labelling it “a question of life or death” for the continent’s industry. To address this, the EU has imposed some tariffs on Chinese EV imports and established an import surveillance mechanism to monitor and report on unfair competition and dumping. The EU will doubtless become more assertive.

The UK response so far has been relatively timid. The government is collaborating with the EU on trade policy for steel and the business secretary, Peter Kyle, will have the power to direct the Trade Remedies Authority to launch investigations into unfair practices.

If Keir Starmer’s expected visit to China in late January goes ahead – contingent on approval of the controversial new London embassy proposal – he may be able to engage with Xi in areas that are not national security, but the prime minister almost certainly will not succeed where Macron failed.

Starmer should resist the temptation to say that a strongly mercantilist China is a significant driver of global and UK growth, which it is not. On the contrary, he should focus instead on gaining first-hand experience of what the second China shock actually means, not least for the UK.

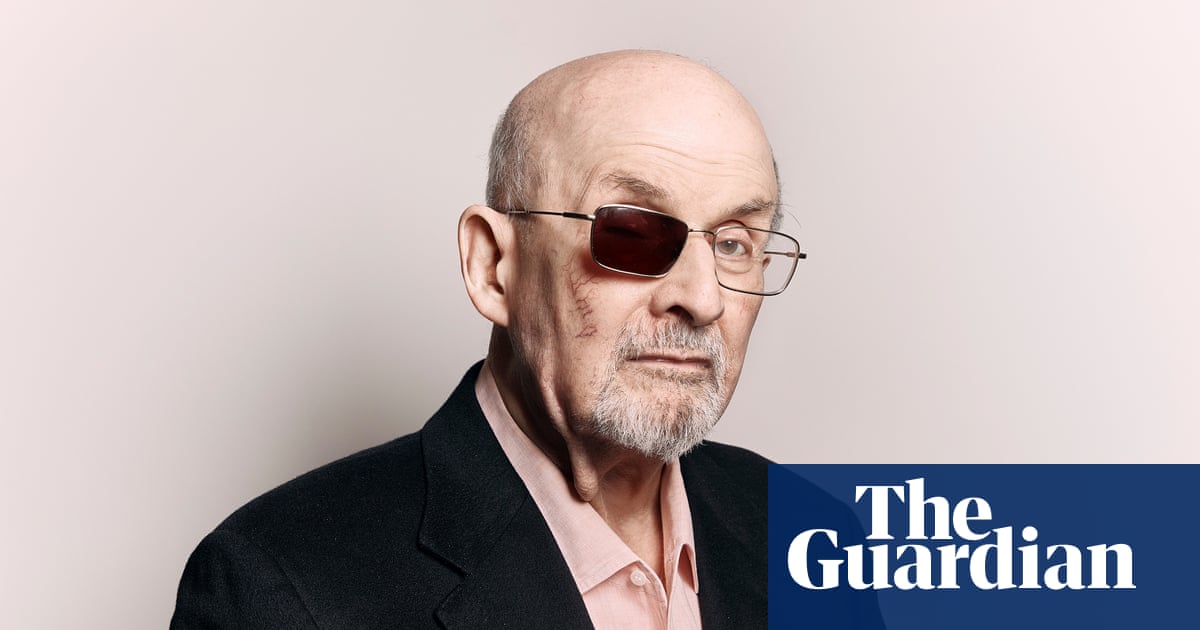

George Magnus is a research associate at Oxford University’s China Centre and at Soas University of London. He is the author of Red Flags: Why Xi’s China is in Jeopardy

1 month ago

36

1 month ago

36