On a brisk Monday evening in May 2010, Gordon Brown stood on the steps of Downing Street and delivered one of the most dramatic announcements of the New Labour era: his resignation as UK prime minister.

The decision came days after a nail-biting general election that left no single party with a clear run at No 10. Brown kept his decision, which followed days of political wrangling, to a tight inner circle. Nick Clegg, who would go on to serve as deputy prime minister of the Conservative-Liberal Democrat coalition, was formally told of Brown’s resignation only 10 minutes before the announcement.

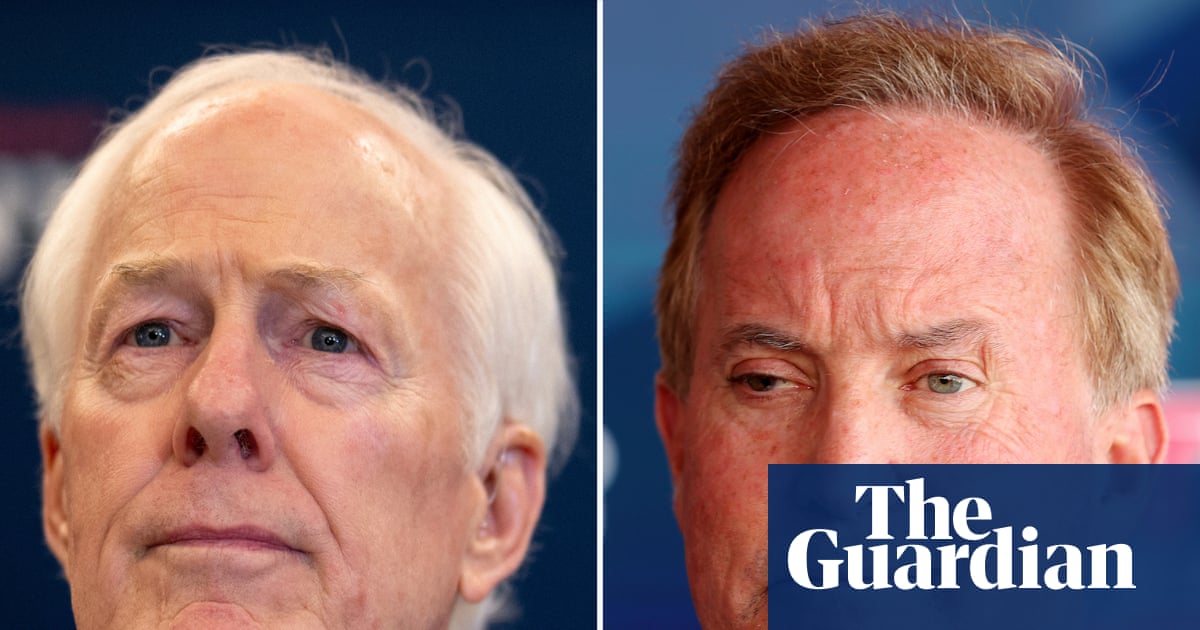

But across the pond, a man named Jeffrey Epstein, a well-connected financier and convicted child sex offender, had been briefed hours before. “Finally got him to go today …” an email believed to be sent by Peter Mandelson informed Epstein on Monday morning.

The apparent tip-off, revealed in the latest tranche of the Epstein files, not only gave Epstein an inside track on the UK’s political future, but also on large moves that were to ripple through global markets.

Those included further wild swings in the value of the British pound, which had already been volatile in the lead-up to the 6 May general election. It fell 2.2% on the day of the vote, its worst day in over a year, illustrating how concerned traders were about the risk of a hung parliament and political instability.

On the day of Mandelson’s apparent tip-off to Epstein, the pound rose by more than two cents to $1.505, before losing all its gains as Brown’s resignation – and his plan for Labour to hold coalition talks with Clegg’s Liberal Democrats – sent shock waves through Westminster. Sterling would gain back a cent a day later, as the Lib Dems struck a deal with the Tories, handing the keys of No 10 to the Conservative leader David Cameron.

While there is no evidence that anyone traded off the leaks, it is just one example of the kind of inside information that Mandelson is alleged to have shared with Epstein, according to the latest batch of documents released by the US Department of Justice this week. Those leaks have caused political outrage across the UK, with Keir Starmer asking police to investigate over concerns they contained market sensitive information.

The market for sterling is one of the largest and most liquid in the world, traded through currency desks globally. Bank of International Settlements data shows it was the fourth most traded currency in 2010.

Among the allegations that Starmer has asked police to investigate are that the former business secretary, who resigned from the House of Lords on Tuesday, may have also given Epstein advance notice of a €500bn eurozone rescue deal.

On the same weekend that Brown was locked in talks over the Labour party’s political future, EU finance ministers were scrambling to strike a deal that would shore up the euro and stave off potential collapse of the eurozone.

What started during the 2008 financial crisis, and had balloonedinto a sovereign debt crisis in Greece, was now threatening the solvency and stability of the eurozone. It had spread along the Mediterranean, triggering market bets against Portugal, Spain, Italy, as well as Ireland, and raising questions over whether European leaders had the political will to save the common currency.

Overall, the crisis, and its resolution, created lucrative opportunities for traders and financiers to profit in European stock markets and moves on the euro.

On the night of Sunday 9 May 2010, while eurozone ministers were still in negotiations, Epstein emailed Mandelson, saying sources were claiming that the €500bn bailout was “almost compelte” [sic].

“Sd be announced tonight,” a reply which appears to have been sent by Mandelson, said. When Epstein asks if the UK business secretary is home, Mandelson wrote “Just leaving No10..will call”. The UK government, which never joined the common currency, did not contribute to the bailout, but the then-chancellor, Alistair Darling, had been in Brussels for the negotiations.

At about 2.30am the next morning in Brussels, eurozone finance ministers announced a jaw-dropping €750bn rescue plan – topped up with €250bn from the International Monetary Fund – to shore up the currency bloc.

It came shortly after markets in Tokyo had opened for trading, and prompted a sharp rally after European stock markets opened at 8am UK time that day. France’s CAC 40 index alone saw significant moves, surged by 8.8% that session. The euro also rallied in early trading before falling back. Currency traders could have been placing trades from as early as 10pm on Sunday, UK time.

Chris Beauchamp, chief market analyst at IG, told the Guardian there would only have been “limited time” to trade on such information before the eurozone bailout was announced, as policymakers had tried to time bailouts with the markets’ open.

In contrast, Mandelson’s tip-off over Brown’s resignation seems to have been sent during market trading hours, meaning it could have been easier for someone with inside information to trade on sterling, government bonds or stocks on the FTSE 100. However, “there’s the risk that the market might not interpret the move in the same way as you did”, Beauchamp noted.

“If proven, the allegations as reported would amount to a serious abuse of entrusted power at the heart of government during a national crisis, said Daniel Bruce, chief executive of the anti-corruption body Transparency International UK. “It is right that the police are now involved.

“Any investigation should examine whether offences have been committed under both the Bribery Act and the common law offence of misconduct in public office.

“With public trust in politics at historic lows, government needs to act decisively to rebuild confidence. While we welcome progress on misconduct legislation and reform of peerage removal rules, ministers should accelerate these reforms to arrest the UK’s declining reputation as a beacon of good governance.”

4 weeks ago

30

4 weeks ago

30