Introduction: Gold and silver slump in 'metals meltdown'

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Commodity, precious metals and crypto asset prices are all sliding today, as the record-breaking rally in gold and silver cools.

Financial markets have begun the new week in a volatile mood, with analysts talking about a “metals meltdown” that is also rattling the equities markets.

Gold is falling back after a months-long rally drove it to a series of record highs. It’s slumped by over 8% so far this session, down to $4,465 a ounce, having hit a record high of nearly $5,600/oz just last week.

Silver is living up to its nickname of the “Devil’s Metal” (for its volatility) – it has slumped by 13% today.

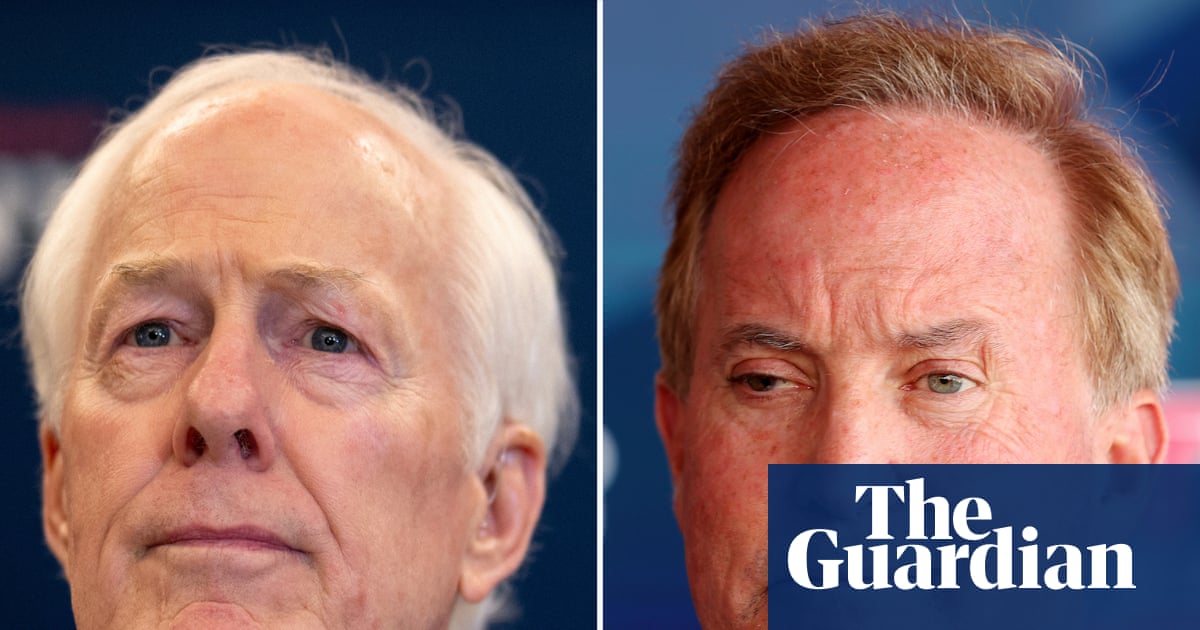

Both gold and silver tumbled last Friday, the day in which Donald Trump said he would nominate Kevin Warsh to be the next chair of the Federal Reserve.

Michael Brown, senior research strategist at Pepperstone, says:

Certainly, the final trading day of January was anything but calm, being dominated by what can only be termed a meltdown in the metals space. In terms of ‘scores on the doors’, spot gold ended Friday with losses of 9%, bullion’s worst day since 2013, and fourth worst in the last 45 years.

Silver, meanwhile, shed as much as 35% at the lows, before trimming losses to end the day a still-chunky 26% lower, the worst daily loss ever, at least per Bloomberg data.

Warsh does have a reputation as a more hawkish policymaker than rival candidates, who wants to shrink the Fed’s balance sheet, so investors may be anticipating tighter monetary policy than expected (although Trump is already joking about suing Warsh if he doesn’t lower interest rates).

Vivek Dhar, a commodities strategist at Commonwealth Bank of Australia (CBA), explains:

“A stronger U.S. dollar is also adding pressure on precious metals and other commodities, including oil and base metals.”

“The decision by markets to sell precious metals alongside U.S. equities suggests investors view Warsh as more hawkish.”

But.. KCM Chief Trade analyst Tim Waterer argues the selloff goes deeper, explaining:

“The Warsh nomination, whilst likely being the initial trigger, did not justify the size of the downward move in precious metals, with forced liquidations and margin increases having a cascading effect.”

The agenda

-

7am GMT: Nationwide house price index for January

-

9am GMT: Eurozone manufacturing PMI for January

-

9.30am GMT: UK manufacturing PMI for January

-

11.45am BST: Bank of England governor Sarah Breeden gives speech on ‘Next generation UK retail payments’

-

3pm GMT: US manufacturing PMI for January

Key events Show key events only Please turn on JavaScript to use this feature

IG: extraordinary brutal sessions push gold into bear market

Gold has plunged into a bear market, reports IG analyst Tony Sycamore.

Sycamore explains:

Gold is diving sharply once again as European markets open, hitting a fresh intraday low of $4402. That is ~10% below Friday’s close of $4895 and $1200 (~ 21%) below last week’s record high of $5602.

In just three brutal sessions, gold has officially flipped from a raging bull market into a bear market according to the technical definition (a drop of 20% or more from recent highs). This kind of velocity and magnitude is extraordinary, even in a year that’s already seen parabolic gains and extreme volatility.

Silver, meanwhile, has dipped marginally below Friday’s low of $73.30 to a low of $71.31 (-15.58% on the day).

The scale of the unwind unfolding in gold today is something I haven’t witnessed since the dark days of the 2008 Global Financial Crisis—leveraged positions getting flushed, stop cascades, and panic selling reminiscent of those chaotic periods.

Asia-Pacific stock markets are a sea of red today, as share prices are hit by market volatility.

Japan’s Nikkei 225 stock index has lost 1.25%, while China’s CSI 300 is down over 2%.

But the real drama was in South Korea, where the KOSPI index has plunged by over 5%, which CNBC says prompted authorities to temporarily halt trading, according to an official note.

Copper, tin and zinc are also being hammered by traders today.

Copper futures prices in Shanghai have fallen by more than 9% today.

Tin prices plunged by 11% in Shanghai too, while in London, zinc prices are down over 4%.

Platinum has slumped by 10% this morning to $1,945 an ounce – last week it hit a record $2,918/oz, before plunging on Friday.

US dollar rallying

The US dollar is strengthening against some rival currencies today.

It’s jumped by 1% against the Norwegian crown, and is also up 0.65% against the Australian dollar – and 0.35% against the Canadian currency.

This looks like a response to Donald Trump’s choice for the next head of America’s central bank.

Ipek Ozkardeskaya, senior analyst at Swissquote, says:

The US dollar has been better bid since Friday, with the dollar index rebounding around 1% off four-year lows following news that the Federal Reserve may have a new Chair.

Kevin Warsh was chosen to be the next Fed President and will replace Jerome Powell if confirmed.

Oil falls 5%

Oil is also sliding, on hopes that the US-Iran crisis is cooling.

Brent crude is down over 5% at $65.78 a barrel, which Reuters has spotted would be the steepest single-session decline in more than 6 months.

The move comes after Donald Trump said Iran was “seriously talking” with Washington, and hinted that a deal that would avoid the use of military strikes could be agreed.

Bitcoin hits lowest since last April

Bitcoin dropped to a 10-month low in early trading today, as investors piled out of riskier assets.

The world’s largest crypto assset dropped to $74,546, its lowest level since 7 April last year – and further from its record high above $125,000 set last year.

Kyle Rodda, senior financial market analyst at capital.com, says some traders are being forced to deleverage after losing money on gold and silver contracts:

The movements in markets on Friday night were a once in a generation event. The mania in gold and silver came to an abrupt halt, with the former crashing by as much as 10% and the latter collapsing by as much as 30%. The move in gold was the largest since the 1920s. The move in silver was the largest in history.

While technically stores of value, still with strong long term fundamentals, the total collapse in precious metals prices shows that any market can become gripped by mania, especially in the age of financialisation and gamification. Given the build up of positioning and leverage involved, the sell-off is bleeding into other markets.

Effectively, a deleveraging is happening, forcing traders to sell other assets to cover losses on their losing precious metals positions. That’s contributing to the sell-off in stocks and probably contributed to Bitcoin’s plunge over the weekend.

Introduction: Gold and silver slump in 'metals meltdown'

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Commodity, precious metals and crypto asset prices are all sliding today, as the record-breaking rally in gold and silver cools.

Financial markets have begun the new week in a volatile mood, with analysts talking about a “metals meltdown” that is also rattling the equities markets.

Gold is falling back after a months-long rally drove it to a series of record highs. It’s slumped by over 8% so far this session, down to $4,465 a ounce, having hit a record high of nearly $5,600/oz just last week.

Silver is living up to its nickname of the “Devil’s Metal” (for its volatility) – it has slumped by 13% today.

Both gold and silver tumbled last Friday, the day in which Donald Trump said he would nominate Kevin Warsh to be the next chair of the Federal Reserve.

Michael Brown, senior research strategist at Pepperstone, says:

Certainly, the final trading day of January was anything but calm, being dominated by what can only be termed a meltdown in the metals space. In terms of ‘scores on the doors’, spot gold ended Friday with losses of 9%, bullion’s worst day since 2013, and fourth worst in the last 45 years.

Silver, meanwhile, shed as much as 35% at the lows, before trimming losses to end the day a still-chunky 26% lower, the worst daily loss ever, at least per Bloomberg data.

Warsh does have a reputation as a more hawkish policymaker than rival candidates, who wants to shrink the Fed’s balance sheet, so investors may be anticipating tighter monetary policy than expected (although Trump is already joking about suing Warsh if he doesn’t lower interest rates).

Vivek Dhar, a commodities strategist at Commonwealth Bank of Australia (CBA), explains:

“A stronger U.S. dollar is also adding pressure on precious metals and other commodities, including oil and base metals.”

“The decision by markets to sell precious metals alongside U.S. equities suggests investors view Warsh as more hawkish.”

But.. KCM Chief Trade analyst Tim Waterer argues the selloff goes deeper, explaining:

“The Warsh nomination, whilst likely being the initial trigger, did not justify the size of the downward move in precious metals, with forced liquidations and margin increases having a cascading effect.”

The agenda

-

7am GMT: Nationwide house price index for January

-

9am GMT: Eurozone manufacturing PMI for January

-

9.30am GMT: UK manufacturing PMI for January

-

11.45am BST: Bank of England governor Sarah Breeden gives speech on ‘Next generation UK retail payments’

-

3pm GMT: US manufacturing PMI for January

4 weeks ago

30

4 weeks ago

30