Google DeepMind to build its first 'automated science laboratory' in the UK

Google DeepMind is to build its first “automated science laboratory” in the UK, in a boost to the country’s artificial intelligence ambitions.

The lab will be focused on materials science research, and will involve “world-class robotics” synthesizing and characterizing hundreds of materials per day, with the goal of significantly shortening the timeline for identifying transformative new materials.

Google DeepMind say the lab, to be built in 2026, will “help turbocharge scientific discovery”, explaining:

Discovering new materials is one of the most important pursuits in science, offering the potential to reduce costs and enable entirely new technologies.

For example, superconductors that operate at ambient temperature and pressure could allow for low cost medical imaging and reduce power loss in electrical grids. Other novel materials could help us tackle critical energy challenges by unlocking advanced batteries, next-generation solar cells and more efficient computer chips.

DeepMind is run by Sir Demis Hassabis, who won the Nobel prize for Chemistry last year for his work using AI to predict and design the structure of proteins (older readers may fondly remember his earlier work on computer games such as Theme Park and Syndicate).

Key events Show key events only Please turn on JavaScript to use this feature

Over in Switzerland, the central bank has left interest rates on hold at 0%, a day after America’s central bank cut rates.

Explaining the decision, the SNB says:

Inflation in recent months has been slightly lower than expected. In the medium term, however, inflationary pressure is virtually unchanged compared to the last monetary policy assessment.

Our monetary policy helps to keep inflation within the range consistent with price stability and supports economic development. We will continue to monitor the situation and adjust our monetary policy if necessary, in order to ensure price stability.

Russia's oil and fuel export revenues lowest level since Ukraine invasion

In the energy sector, Russia’s revenues from exports of crude oil and refined products has fallen to its lowest level since the invasion of Ukraine in 2022.

The International Energy Agency has reported this morning that Moscow’s sales of fossil fuels fell again in November due to lower export volumes and weaker prices.

The Paris-based IEA reported that Russian oil exports declined by 420,000 barrels per day in November. That, combined with weaker prices, slashed revenues to $11bn, $3.6bn less than a year ago.

Looking ahead, the IEA predicted that global oil demand will rise by 830,000 barrels per day in 2025 “amid an improving macroeconomic and trade outlook”, adding:

These brighter prospects extend to our 2026 forecast, which we have upgraded by 90 kb/d, to 860 kb/d y-o-y.

Google’s plans may intensify concerns that the UK is too close to Big Tech firms, as it tries to hold a seat on the AI bandwagon.

Imogen Parker, associate director at the research body Ada Lovelace Institute, says (via the FT):

“We need to ask who is setting the agenda for the UK’s future with AI.”

“In the absence of independent regulation or scrutiny, we’re at the mercy of technology companies’ commercial interests aligning with what the public want.”

“Google partnering with the government to explore how to refine its own Gemini model may or may not benefit teachers and pupils, but it will undoubtedly benefit Google.”

DeepMind also say they are deepening their collaboration with the UK government – and the new robotic science lab is just part of it.

They’re also giving priority access to its “AI for Science” models to UK scientists, including:

-

AlphaEvolve - a Gemini-powered coding agent for designing advanced algorithms

-

AlphaGenome - an AI model to help scientists better understand our DNA

-

AI co-scientist - a multi-agent AI system that acts as a virtual scientific collaborator

-

WeatherNext - a family of state-of-the-art weather forecasting models

In return, the UK will look into how teachers can use Google’s Gemini AI model for teaching England’s national curriculum.

The public sector will also test Google’s AI tools, including Extract - a tool for council planners that uses Gemini to transform old planning documents into digital data.

Google DeepMind to build its first 'automated science laboratory' in the UK

Google DeepMind is to build its first “automated science laboratory” in the UK, in a boost to the country’s artificial intelligence ambitions.

The lab will be focused on materials science research, and will involve “world-class robotics” synthesizing and characterizing hundreds of materials per day, with the goal of significantly shortening the timeline for identifying transformative new materials.

Google DeepMind say the lab, to be built in 2026, will “help turbocharge scientific discovery”, explaining:

Discovering new materials is one of the most important pursuits in science, offering the potential to reduce costs and enable entirely new technologies.

For example, superconductors that operate at ambient temperature and pressure could allow for low cost medical imaging and reduce power loss in electrical grids. Other novel materials could help us tackle critical energy challenges by unlocking advanced batteries, next-generation solar cells and more efficient computer chips.

DeepMind is run by Sir Demis Hassabis, who won the Nobel prize for Chemistry last year for his work using AI to predict and design the structure of proteins (older readers may fondly remember his earlier work on computer games such as Theme Park and Syndicate).

Shares in European semiconductor and tech firms have fallen in early trading after Oracle’s results last night.

The STOXX Europe Technology index is down 0.8%, after Oracle missed market expectations.

Drax considers data centre at Yorkshire power plant

In other AI-related news, power company Drax is drawing up plans to add one gigawatt of data-centre capacity to its Yorkshire power plant.

In its results this morning, the company reveals it is preparing a planning application for a data centre of around MW on land at its Drax Power Station.

It believes infrastructure and transformers previously used to support coal generation could support the operation of a data centre at Drax Power Station as soon as 2027.

Drax says it is focused on options to maximise value from the Drax Power Station site, which covers more than 1,000 acres.

The biomass plant is subsidised to burn wood pellets to generate electricity.

Oracle price targets cut

Financial analysts have been quick to cut their target price for Oracle’s shares following last night’s results (and the drop in after-hours trading).

According to Reuters, Barclays have cut their target price for Oracle Corp to $310 from $330

Bank of America cut their price objective to $300 from $368, and JP Morgan cut their target price to $230 from $270.

Before releasing its results, Oracle closed at $223.01 last night, before falling to $197.26 in after-hours trading…

The disappointment over Oracle’s earnings report is rippling through the AI sector.

In Japan, shares in Softbank – a major AI investor – have fallen by 7.7%, pulling down the Nikkei 225 stock index.

Tokai Tokyo Intelligence Laboratory market analyst Shuutarou Yasuda explains:

“The Nikkei opened higher to track overnight Wall Street’s rises, but the gains were erased by declines of SoftBank Group.”

“The earnings of Oracle raised concerns if the data centre project, in which SoftBank Group is involved, would proceed as expected.”

Overnight risk sentiment is “subdued after weaker revenue and higher capex requirement from Oracle”, reports Mohit Kumar of investment bank Jefferies.

Introduction: Oracle shares slide as earnings cast doubt over AI profitability

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Fears about the profitability of the AI industry are on the rise again, after results from Oracle failed to impress Wall Street.

Oracle, part of the race to provide huge computing power for AI companies, missed revenue and profit expectations last night. It also reported a jump in spending on AI data centers – an area where it has already been spending (and borrowing) heavily.

Capital expenditure for the 2026 fiscal year is now expected to be $15bn higher than the $35bn Oracle estimated in September, showing that the cost of constructing the infrastructure for the AI revolution is rising fast… before many profits show up.

Oracle also booked a one-off $2.7bn pre-tax gain through the sale of its stake in chip designer Ampere Computing.

Oracle chairman Larry Ellison took time out of reshaping the media industry to explain:

“Oracle sold Ampere because we no longer think it is strategic for us to continue designing, manufacturing and using our own chips in our cloud datacenters.

We are now committed to a policy of chip neutrality where we work closely with all our CPU and GPU suppliers. Of course, we will continue to buy the latest GPUs from NVIDIA, but we need to be prepared and able to deploy whatever chips our customers want to buy. There are going to be a lot of changes in AI technology over the next few years and we must remain agile in response to those changes.”

For the last quarter, Oracle reported total revenue of $16.06bn, below with analysts’ average estimate of $16.21bn.

And looking ahead, Oracle said that adjusted profit for the current fiscal third quarter would be $1.64 to $1.68 per share, below analyst estimates of $1.72 per share, according to LSEG data. Oracle’s third-quarter revenue growth forecast of between 16% and 18% also missed analyst estimates of 19.4% growth to $16.87 billion,

The initial response was brutal, with Oracle’s shares sliding by 11.5% in after hours trading on Wall Street.

Ipek Ozkardeskaya, senior analyst at Swissquote, explains why:

The company continued to burn cash last quarter: its free cash flow reached a negative $10 billion. To make matters worse, the company said that it expects capex to reach about $50 billion in the fiscal year ending May 2026 – $15 billion more than its September forecast – and investments at Oracle are financed by debt: overall, the company has about $106 billion in debt.

Frankly, the report was not dramatically bad, but it came to confirm concerns around heavy AI spending, financed by debt, with an unknown timeline for revenue generation, sending Oracle shares down by more than 11% in after-hours trading.

The agenda

-

9am GMT: IEA’s monthly oil market report

-

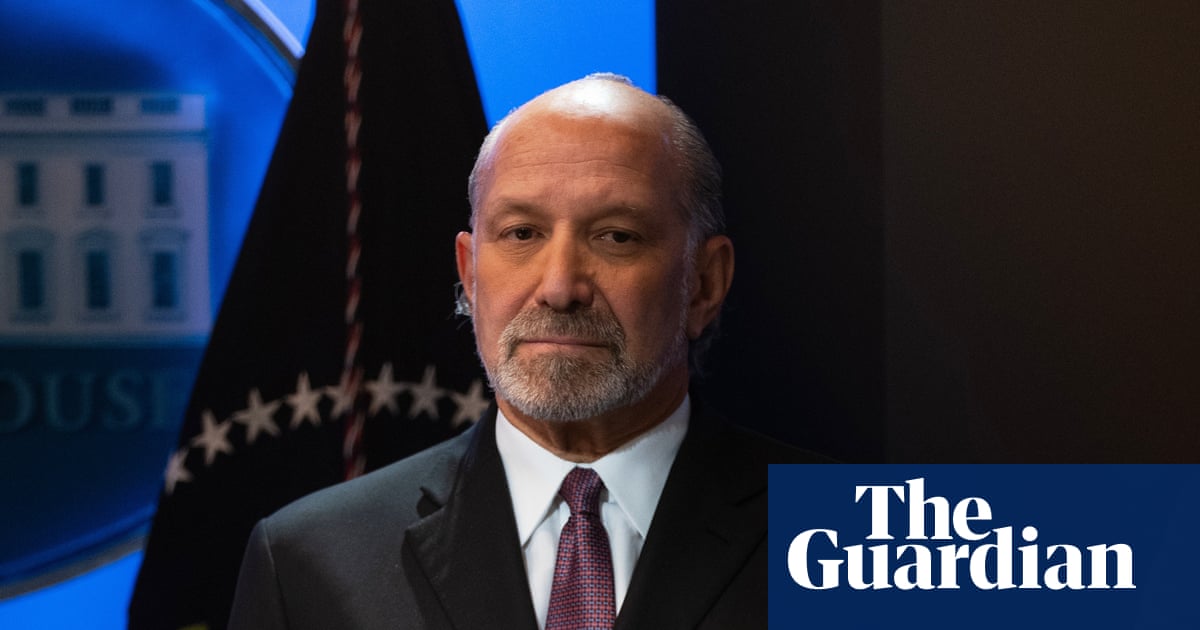

9.50am GMT: Bank of England governor Andrew Bailey speaks at Financial Times Global Boardroom event

-

11am GMT: Turkey’s interest rate decision

-

1.30pm GMT: US trade data for September

-

1.30pm GMT: US initial jobless claims

2 months ago

74

2 months ago

74