Key events Show key events only Please turn on JavaScript to use this feature

Unicredit on Trump’s 'gunboat diplomacy'

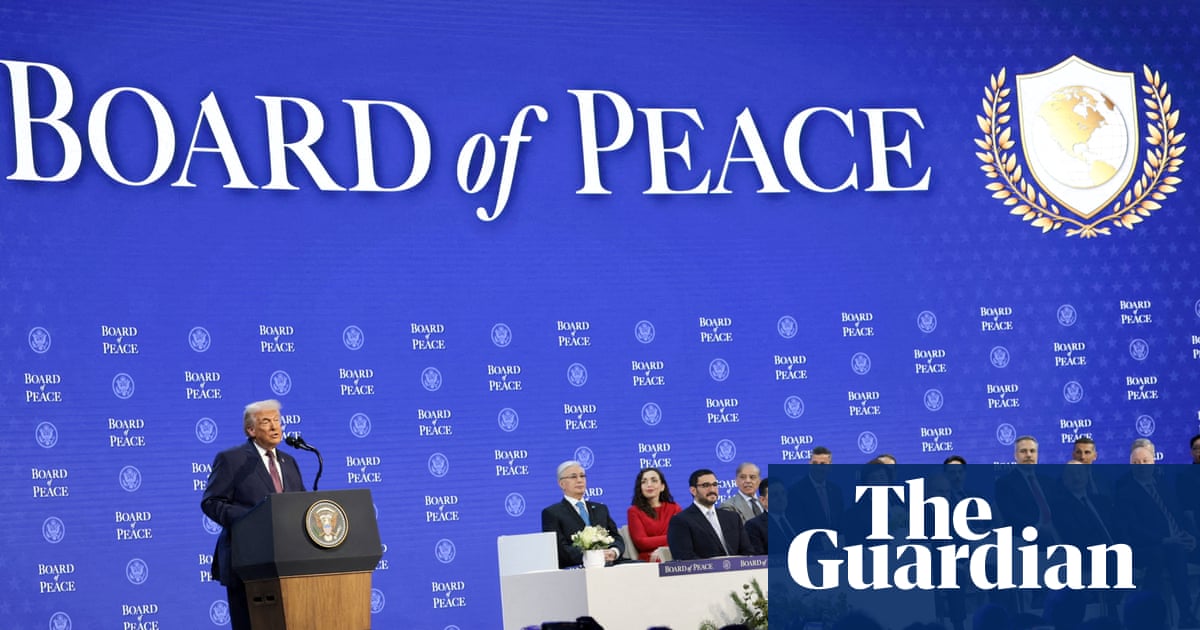

Donald Trump’s “gunboat diplomacy” in Venezuela shows that securing access to critical natural resources such as oil is now a key priority for Washington, say analysts at Unicredit.

They point out, in a note to clients, that the toppling of Venezuelan President Nicolás Maduro marked a decisive break with the rules‑based international order, ushering in a more assertive, America‑First form of hegemony across the western hemisphere.

It also intensifies the US’s strategic rivalry with China, Unicredit point out:

Given that China was the main buyer of smuggled Venezuelan oil and is Caracas’s principal creditor, the move is clearly intended to send a strong signal to Beijing, which has ambitious plans in South America, particularly in resource‑rich countries such as Peru.

In 2023, China and Venezuela formalised an “all‑weather strategic partnership”. Beijing also used oil trade with Caracas to expand the international footprint of the CNY [the yuan], thereby weakening the effectiveness of US sanctions. Maduro’s removal thus serves as a warning to other authoritarian leaders to exercise caution when deepening diplomatic and economic ties with China at the expense of the US.

Shares in energy companies are dropping at the strat of trading in London.

BP (-2.7%) are the top faller on the FTSE 100, with Shell dropping by 1.8%.

That’s pulling the blue-chip FTSE 100 shares index into the red too; it’s down 28 points or 0.27% at 10,095, having hit a record high yesterday.

The value of the Venezuelan oil being claimed by Donald Trump could be as much as $2.8bn – if there is as much as 50 million barrels, at the current US crude price of $56 a barrel.

Trump’s move on Venezuela’s oil is attracting criticism.

“This is confiscatory, imperialistic and there is no justification for it,” said Jeffrey Sonnenfeld, a professor at Yale’s business school, the Financial Times reports.

Sonnenfeld added:

“There is also no need for this oil as we have a global oil glut.”

One theory is that unless the oil is moved, Venezuela’s production could shut down as the country is running out of space to stash crude due to the US blockage.

Introduction: Oil falls after Trump says Venezuela will send supply to US

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The aftermath of the US intervention in Venezuela is continuing to send ripples through the markets.

The oil price is dropping today, after Donald Trump declared that Venezuela will send the US between 30 million to 50 million barrels of oil, which will then be sold… with the president controlling the proceeds, which could be more than $2bn.

Posting on his Truth Social site, Trump declared:

“This Oil will be sold at its Market Price, and that money will be controlled by me, as President of the United States of America, to ensure it is used to benefit the people of Venezuela and the United States!”

There are currently millions of barrels of Venezuelan oil stashed on tankers and in storage tanks due to the US blockage imposed by Trump. The news that this oil could soon follow president Nicolás Maduro in an unexpected journey to the US had an immediate impact on the oil market.

US crude has dropped by 1.6% to $56.21 a barrel, as traders anticipate more supply hitting the market, adding to Tuesday’s losses.

Brent crude, the international benchmark, has dropped by 1.2% – back below $60 a barrel at $59.97.

The move also has geopolitical implications; two sources have told Reuters that supplying the trapped crude to the US could initially require reallocating cargoes originally bound for China.

Jim Reid, market strategist at Deutsche Bank reports that headlines suggesting that the US was keen to avoid disruption to Venezuela’s oil exports pushed oil down yesterday, telling clients:

Reuters reported that Venezuela was in talks to export oil to the US while Bloomberg reported that Chevron had booked extra tankers to Venezuelan ports this month, so potentially mitigating the decline in oil shipments from the country amid the recent US naval blockade.

Indeed, Brent is trading another -1.65% lower this morning after Trump said last night that Venezuela would turn over “between 30 and 50 MILLION barrels” of oil to the US. There wasn’t much extra detail but this sort of volume is around 30-50 days of pre-US blockade production so this could be the oil that has been sitting around and probably doesn’t mark the start of a trend.

There’s a lot for energy companies to process at the moment; earlier this week Trump suggested US taxpayers could reimburse energy companies for repairing Venezuelan infrastructure for extracting and shipping the country’s heavy oil.

The agenda

-

9.30am GMT: UK construction PMI for December

-

10am GMT: Eurozone December inflation flash reading

-

3pm GMT: US JOLTS job openings stats for November

1 month ago

36

1 month ago

36