ONS reveals error with its seasonally adjusted retail sales

Newsflash: Britain’s blundering statistics body has revealed another mistake with the data it produces to track the UK economy.

The Office for National Statistics has admitted that it has discovered an error in the way it produces seasonally adjusted British retail sales data.

The blunder relates to the treatment of “calendar effects”, such as the timing of Easter (which moves between March and April), and to the way that its default data collection periods are aligned to calendar months.

[The ONS uses default data collection periods on a four-week, four-week, five-week cycle, which then need to be aligned to calendar months].

ONS basically say the reason for the issues with quality assurance was seasonal adjustment by calendar month rather than trading month (the 4-4-5 split). ONS say they will switch to calendar month collection at the end of 2026.

— Harvir Dhillon (@HarvirDhillon) September 5, 2025This error forced the ONS to delay the release of the retail sales data – they were initially due two weeks ago.

The ONS, which insists seasonal adjustment is important, reveals that the treatment of these holiday effects and “phase shift” effects were not properly accounted for between January and May this year.

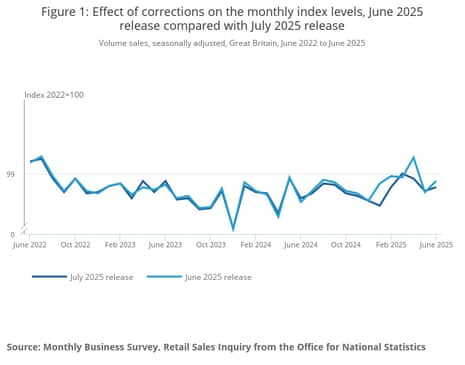

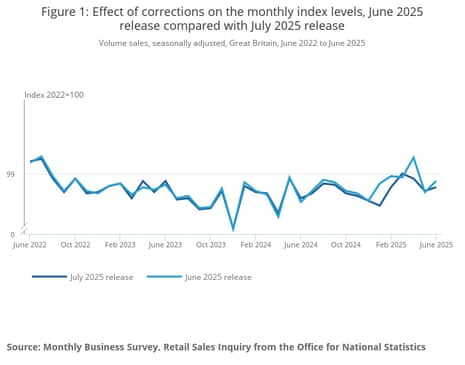

The corrections mean that retail sales were actually lower than previously recorded in January, February, April and June, this chart from the ONS shows:

These errors are another embarrassment to the Office for National Statistics; back in June, a report exposed “deep-seated” issues at the statistics body, which has been struggling to produce data on the state of the labour market too.

Today’s data also shows that the volume of goods bought by shoppers fell by 0.6% in the three months to July 2025 when compared with the three months to April 2025.

But in July alone, retail sales volumes are estimated to have risen by 0.6%, following an increase of 0.3% in June 2025.

Key events Show key events only Please turn on JavaScript to use this feature

Musk's $1tn pay proposal - snap reaction

Tesla’s proposed $1tn pay deal for Elon Musk is “a massive package without precedent in corporate America”, says Bloomberg.

They add:

The plan dangles a financial windfall and expanded control of the company to Musk, already the world’s richest person, after his 2018 package valued in excess of $50 billion was struck down by a Delaware court.

While Tesla appeals that decision, the board is seeking other ways to compensate its CEO, including with an interim stock award in early August valued at about $30 billion.

The Financial Times predicts that “the sheer scale of the deal is likely to revive a fierce debate over the earnings of the world’s richest man”.

The FT points out that achieving the maximum payout of 423mn shares will be “extremely challenging”, adding:

Musk would have to boost Tesla’s market capitalisation to $8.5tn from $1.09tn today. That is more than twice that of Nvidia, currently the most valuable company in the world at $4.2tn.

The Wall Street Journal flags that the proposal would also give Musk increased voting power at the EV maker.

Tesla proposes $1tn pay package for Elon Musk

Tesla’s board has proposed a new pay package for Elon Musk which would allow their chief executive to earn a staggering $1 trillion, if he hits a series of demanding targets.

The plan could see Musk awarded shares totalling 12% of Tesla’s total stock, if he engineers a surge in its value, grows its profits, and hits various operational goals.

Explaining the plan, Tesla’s board say it is vital to keep Musk at the company in the long term, suitably motivated.

They argue that Tesla can help bring about a society that “democratizes autonomous goods and services”, by creating and selling “innovative and affordable technologies at scale”

Tesla board members Robyn Denholm and Kathleen Wilson-Thompson say:

We believe that Elon’s singular vision is vital to navigating this critical inflection point. We also recognize the formidable nature of this undertaking and as a result, the importance of having a leader who is not only willing and capable but eager to meet this challenge.

Simply put, retaining and incentivizing Elon is fundamental to Tesla achieving these goals and becoming the most valuable company in history.

Under the plan, Musk would collect shares in instalment as Tesla’s value rises, from around $1tn today. To hit the maximum share payout, he needs to raise Tesla’s market capitalization to $8.5tn.

That, Tesla point out, is "approximately equal to the combined market capitalizations of each of Meta, Microsoft and Alphabet” today.

Installments of the pay packet will also pay out if Tesla delivers 20m vehicles, sells 10m active FSD subscriptions, sells a million AI robots, gets 1m Robotaxis into Commercial operation, or makes $400bn in adjusted EBITDA profits.

Urging shareholders to back the proposal, Denholm and Wilson-Thompson say:

“If Elon achieves all the performance milestones under this principle-based 2025 CEO Performance Award, his leadership will propel Tesla to become the most valuable company in history.”

The downgrade to UK retail sales this is a sign that consumers were more reluctant to spend – not a good sign for economic growth.

Rob Wood, chief UK economist for Pantheon Macroeconomics, explains:

“Official retail sales volumes growth now averages 0.2% month to month in the first half of 2025, compared to 0.3% previously.

“Weaker sales growth on average this year points to consumers reluctant to spend, which could challenge the growth outlook.”

Wood added there are signs that households have “rebuilt their rainy day savings and are cutting back on the amount of money they squirrel away each month, which should help support spending”.

Barbara Teixeira Araujo, economist at Moody’s Analytics, says today’s retail sales report shows that the first quarter of the year was not as strong as previously thought:

“That U.K. retail sales rose by a strong 0.6% month over month in July—building on a 0.3% increase in June—was definitely good news, especially given the bad vibes coming from the labour market. But we caution against reading too much into the headline.

Not only did the underlying pace of growth remain lacklustre, with growth still falling by 0.6% q/q in the three months to July, but there are now significant questions around the reliability of those figures. Issues found with seasonal adjustment led to a thorough overhaul of the methodology this month, resulting in a completely different story for the first half of 2025—and in a much weaker first quarter than previously anticipated.

While this should not lead to major revisions to GDP growth, it adds insult to injury for the ONS, which is already struggling to produce reliable labour market data.

Moody’s outlook for the UK economy hasn’t changed, though, Teixeira Araujo adds:

With consumer confidence remaining weak and the labour market clearly deteriorating, retailers will continue to struggle with muted demand. While consumer spending won’t crash, it will provide only little support to growth over the coming quarters.”

Here’s our news story on the latest data error at the Office for National Statistics:

Housebuilder shares help to lift FTSE 100

The London stock market is ending the week on the front foot.

The FTSE 100 share index has risen by 30 points, or 0.33%, to 9247 points this morning.

Housebuilders Barratt Redrow (+1.45%) and Berkeley Group (+1.4%) are among the risers, following Halifax’s house price data…. and a statement from Berkeley that it is on track to hit its profit guidance this year.

Experts: 'hard to have confidence' in ONS data

The delay in publishing today’s retail sales data, alongside the large historical revisions due to the ONS’s errors, only add to the questions around the quality of the data, says Matt Swannell, chief economic advisor to the EY ITEM Club.

Swannell says it’s hard to have confidence in the Office for National Statistics’ data:

“The publication of today’s release was delayed by two weeks to ‘allow for further quality assurance’. The ONS revealed that this was to correct an error in its seasonal adjustment process. As a result, today’s release showed downward revisions to the level of sales in most months over the past couple of years, with some very large downgrades to specific months.

The most noteworthy were a 1.8ppt revision to the level of sales in January 2025 and a 1.7ppt cut to the April estimate. The new profile looks more credible, but it’s hard to have much confidence in the data when such fundamental errors have been made, and the revisions are so significant.

Retail analyst Nick Bubb, a long-time critic of the numbers produced by “Planet ONS”, has concerns about its non-seasonally adjusted data (which hasn’t been revised today):

The City expected a modest 0.2% increase in month-on-month seasonally adjusted sales volumes, so the 0.6% increase should please economists (although our friends at Capital Economics have said, in response, that “talk of tax rises ahead of the Budget may yet hold back retail and housing”), but there will be more interest in the big changes in the ONS ‘seasonal adjustment’ techniques, which means, for example, that the bizarre 2.8% dip reported for May has now been revised to a drop of only 1.0%, while the 1.7% increase in April has now been revised down to a 0.4% fall...

“Supermarkets had the largest contribution to headline correction and revision over the last 12 months’, according to the wretched ONS, but it also says, disappointingly, that ‘retail sales non-seasonally adjusted data are unaffected by this, as they refer to raw data where the effects of regular or seasonal patterns have not been removed’.

For us the main problem has always been the accuracy of the underlying sales value figures and our concerns have not been addressed: the Small Retailer sales figures in general have looked too optimistic for some time (implying sampling problems) and the Large Food Retailer sales figures in particular still look much too low in recent months (implying a lack of common sense at the ONS, in terms of cross-checking the widely available industry figures from the BRC-KPMG, as well as Kantar Worldpanel and NIQ).

UK retail sales in July were lifted by the women’s European football tournament,

The ONS reports that non-store retailers and clothing stores sales volumes grew strongly in July 2025.

Retailers attributed this to “new products, good weather, and an increase resulting from the UEFA Women’s EURO 2025 tournament”, which Wales and (winners!) England both took part in.

Following its corrections, the ONS has revised down the quarterly growth rate of retail sales from 1.3% to 0.7% in Q1 and up from 0.2% to 0.3% in Q2.

This will have a slight impact on the UK’s growth data for the first quarter of 2025.

ONS director-general James Benford explains:

Retail sales is used to measure the output of the retail sector and part of household expenditure. It accounts for 4.8% of GDP.

This means that the contribution of retail sales to GDP growth has been revised down from 0.06pp [percentage points] to 0.03pp in the first quarter and is unrevised to two decimal places in the second quarter.

These small corrections will be incorporated into GDP with the Quarterly National Accounts release at the end of September.

But as things stand, that shouldn’t lead to a downward revision to growth. The ONS says:

Despite the change in contribution, and all else being equal, GDP in Quarter 1 2025 would have been unchanged to 1 decimal place at 0.7%.

ONS's director-general apologises for retail sales error

The ONS’s director-general has apologised for the error discovered in the UK’s retail sales data (see earlier post), and the two-week delay getting today’s report.

James Benford, who was parachuted into the statistics body this year to lead its turnaround plan, explains that the approach to seasonal adjustment of retail sales is “unusually complex”.

He says, in a blogpost:

I apologise both for the delay to this release and the error in how we have been seasonally adjusting these data.

Benford adds that the ONS will conduct “a full lessons-learned exercise” and improve its processes and procedures to make sure the error will not be repeated.

But what exactly went wrong? Benford explains that the ONS failed to match its data to the reporting practices of retailers (such as supermarkets),

Many retailers report their sales on a ‘retail calendar’ basis which split the year into planning and reporting periods that have the same number of weekends, which tend to have a larger percentage of sales, and consistently align holidays and shopping events, such as Easter and Black Friday, each year. Reflecting that, our retail sales figures are collected for blocks of four weeks, four weeks and then five weeks (a ‘4-4-5′ approach) and can both sit within a month or span multiple months. This adds complexity to our seasonal adjustment process, given the need to align the collected data to calendar months. The process is complicated further by the pattern of the blocks of four and five weeks sometimes changing.

Our review revealed that we had not seasonally adjusted data correctly because we did not properly account for the adjustment in retail reporting calendars. We have now corrected for this mistake.

Halifax: house prices at record high

UK house prices have hit a new record high, lender Halifax has reported this morning.

Halifax’s house price index shows that prices rose by 0.3% in August, the third monthly rise in a row.

That lifted the average property price to £299,331, a new record high.

Amanda Bryden, head of mortgages at Halifax, says:

“The story of the housing market in 2025 has been one of stability. Since January, prices have risen by less than £600, underlining how steady the market has been despite wider economic pressures.

Affordability remains a challenge, but there are signs of improvement. Interest rates have been on a gradual downward path for nearly two years, and many of the most competitive fixed-rate mortgage deals now offer rates below 4%.

Combined with strong wage growth – which has outpaced house price inflation for nearly three years – this is giving more prospective buyers the confidence to take the next step. Summer is typically a quieter period for the market, so the recent rise in mortgage approvals to a six-month high is an encouraging sign of underlying demand.”

However, rival lender Nationwide reported earlier this week that house prices fell in August, as high mortgage costs dampened activity, so the picture isn’t entirely clear….

ONS reveals error with its seasonally adjusted retail sales

Newsflash: Britain’s blundering statistics body has revealed another mistake with the data it produces to track the UK economy.

The Office for National Statistics has admitted that it has discovered an error in the way it produces seasonally adjusted British retail sales data.

The blunder relates to the treatment of “calendar effects”, such as the timing of Easter (which moves between March and April), and to the way that its default data collection periods are aligned to calendar months.

[The ONS uses default data collection periods on a four-week, four-week, five-week cycle, which then need to be aligned to calendar months].

ONS basically say the reason for the issues with quality assurance was seasonal adjustment by calendar month rather than trading month (the 4-4-5 split). ONS say they will switch to calendar month collection at the end of 2026.

— Harvir Dhillon (@HarvirDhillon) September 5, 2025This error forced the ONS to delay the release of the retail sales data – they were initially due two weeks ago.

The ONS, which insists seasonal adjustment is important, reveals that the treatment of these holiday effects and “phase shift” effects were not properly accounted for between January and May this year.

The corrections mean that retail sales were actually lower than previously recorded in January, February, April and June, this chart from the ONS shows:

These errors are another embarrassment to the Office for National Statistics; back in June, a report exposed “deep-seated” issues at the statistics body, which has been struggling to produce data on the state of the labour market too.

Today’s data also shows that the volume of goods bought by shoppers fell by 0.6% in the three months to July 2025 when compared with the three months to April 2025.

But in July alone, retail sales volumes are estimated to have risen by 0.6%, following an increase of 0.3% in June 2025.

Introduction: US jobs report in focus

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

All eyes will be on the US employment market later today, for signs that America’s jobs market is cooling.

The latest non-farm payroll data is expected to show a slowdown in hiring – economists predict a rise of 75,000 in August. That would be slightly higher than the disappointing 73,000 increase reported in July – which spurred Donald Trump to fire the head of the Bureau of Labor Statistics

The US unemployment rate is set to tick up to 4.3%, from 4.2%

Another weak jobs report would harden fears that the US economy stumbled over the summer, as Trump’s trade war created confusion and drove up costs.

That would make investors even more confident that the US Federal Reserve will cut interest rates next week.

So the markets could be volatile at 1.30pm UK time today.

Chris Weston of brokerage Pepperstone explains:

We know the Fed has placed weight on the NFP outcome, so naturally market players are fixated on it too. This suggests the period around payrolls will be messy from a price action perspective, with algos reacting immediately to the numbers and liquidity thinning out.

How markets ultimately react is tough to plan for — the first move may not be the final move. The clear tactical play is to hold out and put money to work in trades once the collective has had some time to truly digest the data, assess its implications for Fed policy, and consider whether it possibly fuels concerns that the Fed is behind the curve or even that the labour market is perhaps more resilient than feared...

The agenda

-

7am BST: Halifax house price index for August

-

7am BST: US retail sales data for July

-

9am BST: UN FAO‘s food price index

-

1.30pm BST: US non-farm payroll jobs report

3 months ago

49

3 months ago

49