The chief executive of GSK declared yesterday that the USis the best place for pharmaceutical companies to invest.

Emma Walmsley said the US led the world in launches of drugs and vaccines and, alongside China, was the best market for business development.

She is the latest boss of a leading UK drugmaker to talk up business opportunities on the other side of the Atlantic, after AstraZeneca’s Pascal Soriot hailed the “vital importance of the US”.

The UK government, which has been trying to strengthen the pharmaceutical sector, confirmed on Wednesday that the proportion of revenues from new medicine sales that companies need to pay back to the NHS would fall next year – from 22.5% to no more than 15%.

Reducing the record clawback rate was a central demand of the sector but negotiations broke down in late August. Several large companies, including AstraZeneca and US company MSD/Merck, then cancelled or paused large UK investments.

The government has also been pressed into spending 25% more on new NHS medicines as part of a zero tariff deal with the US administration.

Donald Trump, the US president, has criticised other rich countries for paying too little for drugs, leaving the US to shoulder much of the cost of medicines. US prices have historically been much higher, partly because of a complex system of intermediaries.

The National Institute for Health and Care Excellence, which assesses drugs for use on the NHS, will for the first time raise the price threshold at which new medicines are seen to be cost-effective.

However, in a consultation document published on Tuesday, the Department of Health went further and said it wanted to give ministers a limited power to set the cost-effectiveness threshold for new drugs.

Spending on medicines could increase by about £1bn over the next three years, according to the Association of the British Pharmaceutical Industry (ABPI). This has raised concerns about less money to pay for health staff and equipment.

The government says the revenue clawback rate for new medicines will drop to 14.5% next year but payment rates for older, branded medicines will remain unchanged at between 10% and 35%.

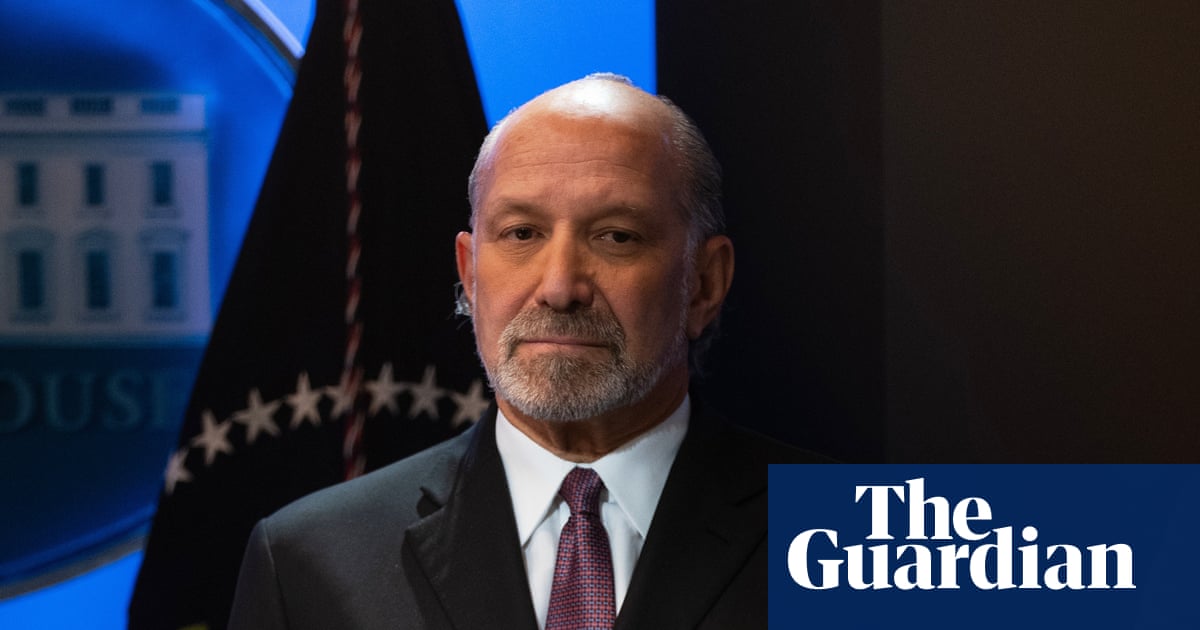

“It’s good that the amount of revenue companies will need to pay to the UK government has come down in 2026,” said Richard Torbett, the chief executive of the ABPI.

Torbett also said the proposed 15% cap should give companies more certainty but it was just a first step in making Britain more competitive: “Payment rates remain much higher than in similar countries, and there is work to do to accelerate the NHS’s adoption and use of cost-effective medicines to improve patient care.”

In her interview with the BBC, Walmsley said GSK would not “shy away” from its interests in the US, where it makes half of its revenues. GSK recently outlined plans to invest $30bn (£23bn) in the US by 2030.

2 months ago

55

2 months ago

55