China accuses Nvidia of violating antitrust law

Newsflash: China has accused chip giant Nvidia of breaking the country’s anti-trust laws.

Beijing’s State Administration for Market Regulation (SAMR) has declared that, following a preliminary investigation, Nvidia was found to have “violated the anti-monopoly law of the People’s Republic of China”.

SAMR added that it has decided to conduct further investigation into Nvidia, whose high-end chips are in hot demand for artificial intelligence systems.

SAMR’s statement comes as trade talks between Chinese and US officials take place in Madrid.

Nvidia has been in the firing line of the US-China trade war. In April, its H20 and MI308 chips were banned from sale to China; then in August, Nvidia and AMD agreed to give the US government 15% of their revenue from advanced chips sold to China in return for export licences to the key market.

Key events Show key events only Please turn on JavaScript to use this feature

Joshua Mahony, chief market analyst at Scope Markets, predicts that the ruling against Nvidia could strain those US-China trade talks in Madrid:

Attention in the US remains fixed on trade and monetary policy, with US-China negotiations in Madrid likely to be strained by the Chinese ruling that Nvidia had violated anti-monopoly laws.

The Chinese market regulator’s ruling has dragged the tech giant 2.2% lower in pre-market trade, putting downward pressure on the wider markets

Lisa O’Carroll

The news that Nvidia has “violated” China’s anti-monopoly law came as a high level Chinese delegation enter a second day of talks in Madrid with the US over tariffs.

The US and China are close to reaching an agreement on the sale of TikTok, US treasury secretary Scott Bessent, as talks resume in Madrid.

Even if a deal over Chinese divestment from TikTok is not reached it would not affect relations, Bessent added.

The two sides met for six hours on Sunday in Palacio de Santa Cruz, home to Spain’s foreign ministry, ahead of the US imposed 17 September deadline to divest TikTok.

Bessent added:

“Our Chinese counterparts have come with a very aggressive ask … we are not willing to sacrifice national security for a social media app.”

Although a deal is not expected today, one option is that the US could extend the deadline for divestment, an issue that is now intertwined with wider talks.

“From the Chinese perspective, they view as part and parcel of the potential TikTok deal a variety of matters, whether it’s tariffs or other measures that have been taken over years,” trade representative Jamieson Greer, who is also in Madrid, said.

The US and the UK are expected to resume talks about their trade deal on Tuesday when Bessent is due to meet UK finance minister Rachel Reeves ahead of Trump’s state visit on Wednesday.

Nvidia shares drop

Shares in Nvidia have dropped by 2.5% in premarket trading, after China’s markets regulator declared it has violated the country’s antitrust rules.

China accuses Nvidia of violating antitrust law

Newsflash: China has accused chip giant Nvidia of breaking the country’s anti-trust laws.

Beijing’s State Administration for Market Regulation (SAMR) has declared that, following a preliminary investigation, Nvidia was found to have “violated the anti-monopoly law of the People’s Republic of China”.

SAMR added that it has decided to conduct further investigation into Nvidia, whose high-end chips are in hot demand for artificial intelligence systems.

SAMR’s statement comes as trade talks between Chinese and US officials take place in Madrid.

Nvidia has been in the firing line of the US-China trade war. In April, its H20 and MI308 chips were banned from sale to China; then in August, Nvidia and AMD agreed to give the US government 15% of their revenue from advanced chips sold to China in return for export licences to the key market.

Mittal increases influence at BT with board seats

Sunil Bharti Mittal and Gopal Vittal have taken seats on the BT board, increasing the billionaire’s influence over the telecomes operator.

The Indian billionaire, purchased a 24.5% stake through his Bharti Enterprises from Patrick Drahi last year, is to join the board as a non-executive director.

Gopal Vittal, vice chair and managing director managing director of Mittal’s Indian telecoms operator Bharti Airtel will also take a non-executive position on the board.

The move expands Mittal’s influence over BT, in which he has said he is open to potentially increasing his stake, although he shas said he does not have plans to buy the business.

A condition of the agreement – known as a “standstill restriction” - is that he cannot purchase more shares, or launch a takeover bid without BT’s consent.

Following the announcement shares in BT fell by 3.5%, as any future prospect of a takeover has been effectively taken off the table.

AstraZeneca shares drop after Cambridge investment pause

Pharmaceuticals giant AstraZeneca is among the top fallers on the FTSE 100 index this morning, after pausing its planned £200m investment in its Cambridge research site.

After the market closed on Friday night, AstraZeneca revealed that the planned £200m expansion of its Cambridge research site was now on ice.

An AstraZeneca spokesperson said on Friday:

“We constantly reassess the investment needs of our company and can confirm our expansion in Cambridge is paused. We have no further comment to make.”

The move rounded off a poor week for the UK pharmaceutical industry, with drugmaker Merck scrapping a £1bn London research centre

AstraZeneca are the most valuable company listed in London. Richard Hunter, head of markets at interactive investor, says the Cambridge decision could increase the risk that the company shifts to another stock market (which it has reportedly considered).

AstraZeneca drifted lower after announcing a pause in its planned £200m expansion at its Cambridge site, hot on the heels of other pharmaceutical strategic withdrawals given the perceived lack of interest from the government.

Despite the dip, the shares are up by 21% so far this year, but from a UK perspective such moves add to the possibility that Astra could seek to reflect its US exposure by switching its primary listing, which would be a major reputational blow.”

Today’s warnings about higher food prices coming in the UK are likely to cause fresh worries about how long borrowers will have to wait until Bank of England policymakers vote for another cut, reports Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Streeter adds:

They are set to leave the base rate unchanged on Thursday and aren’t expected to make a move until next Spring.

The Food and Drink Federation is forecasting food inflation could reach 5.7% by the end of December and still be running at 3.1% by the end of 2026. Higher employer and packaging taxes are being blamed for increasing costs for companies, which they can no longer absorb.

Wednesday’s inflation snapshot is expected to show that the Consumer Prices Index has crept up again, further away from the Bank’s 2% target, making it even more likely that borrowing costs will stay elevated for longer.

Elsewhere on the London market, shares in electricals retailer AO World have jumped by 9.5% after it lifted its profit forecasts.

In a trading update, AO World upgraded its forecast for adjusted pre-tax profits for the current financial year to £45m to £50m, up from a previous guidance range of £40m to £50m.

John Roberts, AO’s founder and CEO, says:

“I’m delighted that we are on track to deliver yet another period of double-digit revenue growth and a strong profit performance, whilst maintaining our globally leading customer service standards.

Our strategy as set out at our full year results is working and we have an exciting pipeline of further value to deliver for customers in H2. Our Five Star membership programme continues to go from strength to strength as our customers realise the exceptional value that it offers. This, combined with our ongoing efforts to broaden our product range, is an increasingly key driver of our performance.

Sainsbury's shares hit four-year high after Argos talks collapse

Shares in UK supermarket chain Sainsbury’s have jumped to a four-year high at the start of trading in London, after talks to sell its Argos general merchandise operation collapsed.

News broke over the weekend that Sainsbury’s was in talks with China’s JD.com over a potential sale of Argos,which it bought for more than £1bn less than a decade ago.

But last night, Sainsbury’s revealed the deal was off, saying:

“JD.com has communicated that it would now only be prepared to engage on a materially revised set of terms and commitments which are not in the best interests of Sainsbury’s shareholders, colleagues and broader stakeholders.

Accordingly, Sainsbury’s confirms that it has now terminated discussions with JD.com.”

Despite the deal collapsing, Sainsbur’s shares are leading the FTSE 100 risers this morning – up 5.17% at 323p, their highest since August 2021.

China's economy slows in August

China’s economy stumbled over the summer, new data shows, increasing pressure on Beijing to stimulate its economy.

China’s factory output and retail sales both rose at the weakest rate this year in August.

Retail sales rose 3.4% in August from a year earlier, down from 3.7% in July, while industrial output growth slowed to 5.2% in August, down from 5.7% the previous month.

Year-to-date fixed-asset investment saw a significant slowdown, growing by just +0.5% compared to +1.6% in January-July.

Jim Reid of Deutsche Bank reports that this “weak monthly data dump from China” is encouraging hopes of further policy stimulus, with China’s CSI300 share index up 0.2% today and South Korea’s KOSPI rising 0.4%.

As well as warning about food inflation pressures, German discount chain Aldi has also said it will invest £1.6bn over the next two years in the UK.

This will include opening 80 more stores – part of Aldi’s plan to eventually operate 1,500 stores across the UK, up from 1,060 at present.

A total of 21 stores are set to open in the next 13 weeks, including Shoreditch in London, Durham in the North East, and Kirkintilloch in Scotland, Aldi reports.

Aldi’s latest financial results, released this morning, show that sales rose to £18.1bn in 2024, up from £17.9bn in 2023. But it also reports that operating profit fell to £435.5m from £552.9m the previous year, a profit margin of 2.4%.

Food inflation tipped to accelerate, as Aldi warns budget could push prices higher

Fears are growing that UK food inflation is accelerating, hurting households across the country and making it harder for the Bank of England to lower interest rates.

The Food and Drink Federation (FDF), an industry body, has upgraded its food and non-alcoholic drink inflation forecast, projecting that it could reach 5.7% by December. This is up from its previous forecast of 4.8%.

The FDF says food manufacturers suffer the financial burden of government policies, such as changes to employer National Insurance Contributions, and the new packaging tax, Extended Producer Responsibility (EPR).

Dr Liliana Danila, lead economist at The Food and Drink Federation, explains:

“Food and drink inflation has been climbing steadily all year, with no sign of easing. Looking at the longer-term picture, today’s prices are steeper than anything in recent decades. The five-year average is running at more than double the rate seen between 1990-2010.

“Inflationary spikes between 2020 and 2023 were driven by geopolitical shocks which created supply chain disruptions and sharp rises in energy and raw ingredients. With most of these costs now stabilised, this new inflation surge is fuelled by the financial impact of domestic policies, now trickling down to supermarket shelves.”

Separately, the boss of Aldi has warned that any measures in the Budget that further increase costs on employers could lead to higher food prices.

Giles Hurley, chief executive of Aldi UK, told the BBC that the National Insurance rise and new packaging rules had already “rippled through to prices on the shelf edge” across the supermarket sector.

He added:

“Any policies which affect the operating costs of business should be considered very, very carefully because of the very real risk they find their way... back into the food system and onto prices.”

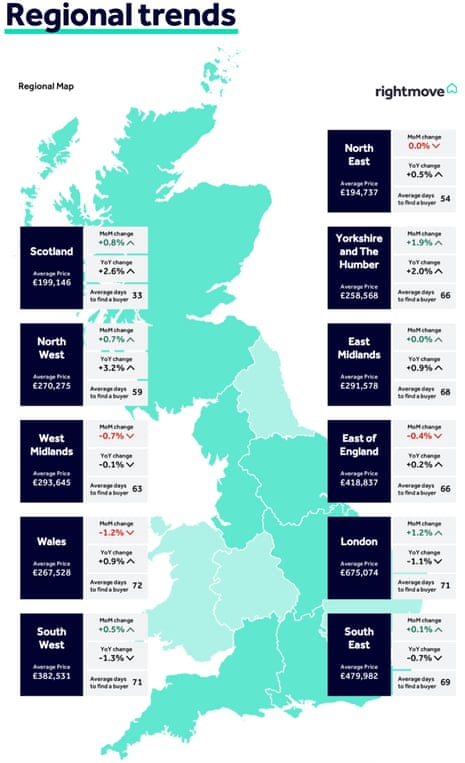

Here’s a map from Rightmove showing the state of play in the UK housing market:

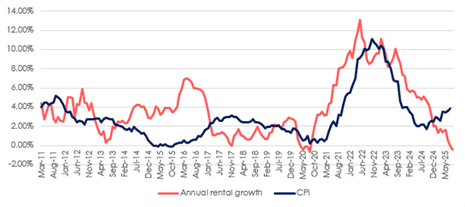

The cost of renting a property in Great Britain has also dipped this summer.

Estate agent Hamptons reports that newly agreed rents in Great Britain fell -0.4% year-on-year in August 2025 to £1,387 per calendar month, a saving of £6 per month.

Hampsons says this is the largest annual fall post-Covid and the joint second-largest annual fall in rents since it began tracking lettings costs in March 2011.

New rents are falling most sharply in London, Hamptons says.

Inner London rents fell by 5.8% over the last 12 months, the largest decline since May 2021, while overall across the capital they are 3.3% lower than a year ago, according to its data.

Aneisha Beveridge, head of research at Hamptons, says “the tide is finally turning”, after several years of rapid rental growth, explaining:

For the ninth month in a row, rents have risen more slowly than inflation—offering tenants a rare moment of financial respite. While the monthly savings may seem modest, they mark a significant shift in the rental market’s role in driving inflation.

“Over the longer term, rents have consistently outpaced inflation, which means tenants today are paying more than they would have if rents had simply tracked CPI. For the most part, this has mirrored the rising cost pressures facing landlords. But this recent slowdown suggests the market is recalibrating. With affordability stretched and demand softening, landlords are having to adjust to attract tenants.

“Like wages, rents don’t often fall. In fact, there have only been six months over the last 14 years when rents have fallen nationally on an annual basis.

Autumn budget tax jitters 'risk slowing the market'

Rightmove adds that it’s not seeing any “immediate reaction” from movers to rumours that chancellor Rachel Reeves may change property taxes.

But, it cautions that speculation about the Autumn Budget risk slowing the parts of the market that are already underperforming (ie, the South, and London).

Rightmove’s Colleen Babcock explains:

Rumours of property tax changes began swirling in mid August, and with the Budget itself not arriving until the end of November, this kind of extended uncertainty can affect market activity, especially in the higher price brackets.

Movers want to be confident in planning their moving costs.

Our real-time data has not yet picked up any major shifts, however it’s understandable that those who could be negatively affected by the rumoured changes might be in the process of reassessing their short- and medium-term plans.

Last month, the Guardian reported that the Treasury is considering a new tax on the sale of homes worth more than £500,000, in a move towards a radical overhaul of stamp duty and council tax.

According to Rightmove, more than half (59%) of agreed property sales in London so far this year have been over £500,000 and would be subject to the speculated new tax replacing stamp duty, versus an average of 22% outside London.

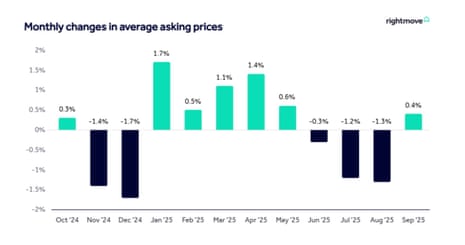

Introduction: First annual drop in UK houses asking prices since January 2024

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The UK housing market appears to be cooling, driven by London and the south of England.

New figures from property portal Rightmove this morning show that the average asking price on a UK home is 0.1% lower than this time last year, following several months of muted price growth.

That’s the first annual decline in asking prices since January 2024, which Rightmove attribute to several months of “competitive pricing” by new sellers over the summer, as some cut prices to secure a buyer.

The decline in asking prices is mainly seen in the south of the country; they’re down 1.1% in London, -0.7% in South East England, and -1.3% in the South West.

In contrast, asking prices are still 2.6% higher than a year ago in Scotland, and 3.2% higher in the North West of England.

On a month-on-month basis, though, Rightmove reports that the average asking price rose by 0.4% (+£1,517) to £370,257.

Colleen Babcock, property expert at Rightmove, explains:

“We’d expect to see a slight uptick in new seller asking prices in September, with the traditional back to school season boosting activity heading into autumn. This year’s 0.4% September price rise is a little lower than the norm, which is an average of 0.6% at this time of year.

However, prices have now dipped slightly from where they were at this time last year after a summer of competitive pricing by sellers, and it’s the south of England which is driving this small dip. It’s the sensible and attractive seller pricing we’ve been reporting which has been helping to drive more sales activity compared to last year. Static house prices, rising wages, and lower mortgage rates all assist buyer affordability, which has led to an increase in the number of sales agreed compared to a year ago.”

The agenda

-

10am BST: Eurozone trade balance for July

-

Noon: Bank of International Settlements’ Quarterly Review of financial markets

-

1.30pm BST: US Empire State Manufacturing Index

3 months ago

53

3 months ago

53